1000+ Xiaomi Employees Reportedly Working on Proprietary "Xring" Chipset Designs

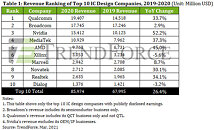

Mid-way through April, a few Asian media outlets proposed a fairly recent formation of Xiaomi's "chip platform department"—most likely operating as part of the Chinese corporation's mobile phone development operation. Industry insiders claimed that this special branch was tasked with the designing of "Xuanjie" chipsets, with added expertise provided by an ex-Qualcomm marketing director. Weeks later, Jukanlosreve has weighed in with alleged new details. The keen tracker—of unannounced flagship smartphone chips and semiconductor business revelations—believes that previous leaks were of merit, but made some corrections.

Given reported greater than expected "new division" headcounts, Xiaomi probably established its "Xring SoC" team a while ago—on this topic, Jukanlosreve divulged: "it operates as a new company; independent of the original parent firm. It's not a small team either—it has over 1000 people. To be honest, I see it as a positive development if a domestically produced chip gets used in a domestically made smartphone and sold globally. I genuinely hope it becomes reality. If Xring succeeds, it might encourage more companies to get involved, and even engineers currently working at major firms could see better pay opportunities."

Given reported greater than expected "new division" headcounts, Xiaomi probably established its "Xring SoC" team a while ago—on this topic, Jukanlosreve divulged: "it operates as a new company; independent of the original parent firm. It's not a small team either—it has over 1000 people. To be honest, I see it as a positive development if a domestically produced chip gets used in a domestically made smartphone and sold globally. I genuinely hope it becomes reality. If Xring succeeds, it might encourage more companies to get involved, and even engineers currently working at major firms could see better pay opportunities."