Sunday, August 15th 2010

NVIDIA Reports Financial Results for Second Quarter Fiscal 2011

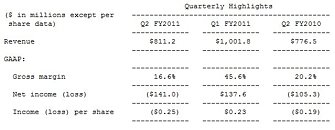

NVIDIA reported revenue of $811.2 million for the second quarter of fiscal 2011 ended Aug. 1, 2010, down 19.0 percent from the prior quarter and up 4.5 percent from $776.5 million from the same period a year earlier.

On a GAAP basis, the company recorded a net loss of $141.0 million, or $0.25 per share, compared with net income of $137.6 million, or $0.23 per diluted share, in the previous quarter and a net loss of $105.3 million, or $0.19 per share, in the same period a year earlier. GAAP gross margin was 16.6 percent compared with 45.6 percent in the previous quarter and 20.2 percent in the same period a year earlier.Results were impacted by a large inventory write-down and a charge related to a weak die/packaging material set.

The inventory write-down was a consequence of weakened demand for consumer graphics processing units (GPUs) as higher memory prices and economic weakness in Europe and China led to a greater-than-expected shift to lower-priced GPUs and PCs with integrated graphics.

The weak die/packaging material set was used in certain versions of previous generation MCP (chipset) and GPU products shipped before July 2008 and used in notebook configurations. The charge, of $193.9 million, includes additional remediation costs, as well as the estimated costs of a pending settlement of a class action lawsuit consolidated in the District Court for the Northern District of California in April 2009 related to this same matter. The settlement is subject to certain approvals, including final approval by the court. Excluding this die/packaging material charge and the associated tax impact, non-GAAP net income was $20.1 million, or $0.03 per diluted share.

"Rapidly changing market conditions made for a challenging quarter," said Jen-Hsun Huang, NVIDIA's CEO and president. "We delivered excellent results in Quadro professional graphics, Tesla GPU computing, and our Tegra system-on-a-chip business. But our GeForce consumer business fell significantly short of expectations amid weak PC demand in Europe and China. Although demand among end-users remains uncertain, we expect to drive revenue and grow market share with new products that are gaining momentum in each of our businesses."

Outlook

The outlook for the third quarter of fiscal 2011 is as follows:

On a GAAP basis, the company recorded a net loss of $141.0 million, or $0.25 per share, compared with net income of $137.6 million, or $0.23 per diluted share, in the previous quarter and a net loss of $105.3 million, or $0.19 per share, in the same period a year earlier. GAAP gross margin was 16.6 percent compared with 45.6 percent in the previous quarter and 20.2 percent in the same period a year earlier.Results were impacted by a large inventory write-down and a charge related to a weak die/packaging material set.

The inventory write-down was a consequence of weakened demand for consumer graphics processing units (GPUs) as higher memory prices and economic weakness in Europe and China led to a greater-than-expected shift to lower-priced GPUs and PCs with integrated graphics.

The weak die/packaging material set was used in certain versions of previous generation MCP (chipset) and GPU products shipped before July 2008 and used in notebook configurations. The charge, of $193.9 million, includes additional remediation costs, as well as the estimated costs of a pending settlement of a class action lawsuit consolidated in the District Court for the Northern District of California in April 2009 related to this same matter. The settlement is subject to certain approvals, including final approval by the court. Excluding this die/packaging material charge and the associated tax impact, non-GAAP net income was $20.1 million, or $0.03 per diluted share.

"Rapidly changing market conditions made for a challenging quarter," said Jen-Hsun Huang, NVIDIA's CEO and president. "We delivered excellent results in Quadro professional graphics, Tesla GPU computing, and our Tegra system-on-a-chip business. But our GeForce consumer business fell significantly short of expectations amid weak PC demand in Europe and China. Although demand among end-users remains uncertain, we expect to drive revenue and grow market share with new products that are gaining momentum in each of our businesses."

Outlook

The outlook for the third quarter of fiscal 2011 is as follows:

- Revenue is expected to be up 3 to 5 percent from the second quarter.

- GAAP gross margin is expected to increase to 46.5 to 47.5 percent.

- GAAP operating expenses are expected to be approximately $300 million.

- GAAP tax rate of 17 to 19 percent.

- NVIDIA launched and shipped the GeForce GTX 460, bringing the gaming benefits of the Fermi architecture to lower price points.

- NVIDIA launched and shipped a range of Quadro products based on the Fermi architecture for workstation professionals.

- NVIDIA extended its reach in supercomputing as IBM started offering products based on Tesla; these also use Fermi-generation GPUs.

26 Comments on NVIDIA Reports Financial Results for Second Quarter Fiscal 2011