Sunday, August 15th 2010

NVIDIA Reports Financial Results for Second Quarter Fiscal 2011

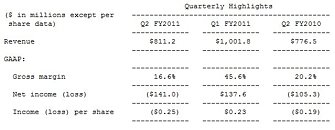

NVIDIA reported revenue of $811.2 million for the second quarter of fiscal 2011 ended Aug. 1, 2010, down 19.0 percent from the prior quarter and up 4.5 percent from $776.5 million from the same period a year earlier.

On a GAAP basis, the company recorded a net loss of $141.0 million, or $0.25 per share, compared with net income of $137.6 million, or $0.23 per diluted share, in the previous quarter and a net loss of $105.3 million, or $0.19 per share, in the same period a year earlier. GAAP gross margin was 16.6 percent compared with 45.6 percent in the previous quarter and 20.2 percent in the same period a year earlier.Results were impacted by a large inventory write-down and a charge related to a weak die/packaging material set.

The inventory write-down was a consequence of weakened demand for consumer graphics processing units (GPUs) as higher memory prices and economic weakness in Europe and China led to a greater-than-expected shift to lower-priced GPUs and PCs with integrated graphics.

The weak die/packaging material set was used in certain versions of previous generation MCP (chipset) and GPU products shipped before July 2008 and used in notebook configurations. The charge, of $193.9 million, includes additional remediation costs, as well as the estimated costs of a pending settlement of a class action lawsuit consolidated in the District Court for the Northern District of California in April 2009 related to this same matter. The settlement is subject to certain approvals, including final approval by the court. Excluding this die/packaging material charge and the associated tax impact, non-GAAP net income was $20.1 million, or $0.03 per diluted share.

"Rapidly changing market conditions made for a challenging quarter," said Jen-Hsun Huang, NVIDIA's CEO and president. "We delivered excellent results in Quadro professional graphics, Tesla GPU computing, and our Tegra system-on-a-chip business. But our GeForce consumer business fell significantly short of expectations amid weak PC demand in Europe and China. Although demand among end-users remains uncertain, we expect to drive revenue and grow market share with new products that are gaining momentum in each of our businesses."

Outlook

The outlook for the third quarter of fiscal 2011 is as follows:

On a GAAP basis, the company recorded a net loss of $141.0 million, or $0.25 per share, compared with net income of $137.6 million, or $0.23 per diluted share, in the previous quarter and a net loss of $105.3 million, or $0.19 per share, in the same period a year earlier. GAAP gross margin was 16.6 percent compared with 45.6 percent in the previous quarter and 20.2 percent in the same period a year earlier.Results were impacted by a large inventory write-down and a charge related to a weak die/packaging material set.

The inventory write-down was a consequence of weakened demand for consumer graphics processing units (GPUs) as higher memory prices and economic weakness in Europe and China led to a greater-than-expected shift to lower-priced GPUs and PCs with integrated graphics.

The weak die/packaging material set was used in certain versions of previous generation MCP (chipset) and GPU products shipped before July 2008 and used in notebook configurations. The charge, of $193.9 million, includes additional remediation costs, as well as the estimated costs of a pending settlement of a class action lawsuit consolidated in the District Court for the Northern District of California in April 2009 related to this same matter. The settlement is subject to certain approvals, including final approval by the court. Excluding this die/packaging material charge and the associated tax impact, non-GAAP net income was $20.1 million, or $0.03 per diluted share.

"Rapidly changing market conditions made for a challenging quarter," said Jen-Hsun Huang, NVIDIA's CEO and president. "We delivered excellent results in Quadro professional graphics, Tesla GPU computing, and our Tegra system-on-a-chip business. But our GeForce consumer business fell significantly short of expectations amid weak PC demand in Europe and China. Although demand among end-users remains uncertain, we expect to drive revenue and grow market share with new products that are gaining momentum in each of our businesses."

Outlook

The outlook for the third quarter of fiscal 2011 is as follows:

- Revenue is expected to be up 3 to 5 percent from the second quarter.

- GAAP gross margin is expected to increase to 46.5 to 47.5 percent.

- GAAP operating expenses are expected to be approximately $300 million.

- GAAP tax rate of 17 to 19 percent.

- NVIDIA launched and shipped the GeForce GTX 460, bringing the gaming benefits of the Fermi architecture to lower price points.

- NVIDIA launched and shipped a range of Quadro products based on the Fermi architecture for workstation professionals.

- NVIDIA extended its reach in supercomputing as IBM started offering products based on Tesla; these also use Fermi-generation GPUs.

26 Comments on NVIDIA Reports Financial Results for Second Quarter Fiscal 2011

oh and of corse the ati 6xxx cards coming out this year and price drops for the 5xxx cards may be anoher pain for nvidia, hopefully their gf108 cores will give some awesome performace for the price and get them some more sales (im not saying current sales are bad but im sure nvidia thinks they could be better)

Die size is a very bad metric for how much a card costs to make and it's profits anyway. There's many other factors. First of all, the chip accounts for about 10% of the price of a high-end card ($25-50), so even if the there's a significant die difference that doesn't mean a card would cost a lot more. It all depends on the bussiness model and relations wth partners etc. For example if chip A costs $20 and chip B costs $30, that means B costs 50% more (it's 50% bigger too), but the final prodcts may actually end up costing $300 and $310 respectively, not a big deal at all.

And second, does Nvidia pay the same as AMD for waffers? Certainly not. Nvidia is 40% of TSMCs bussiness, Ati is about 15%. Ati is going to leave in favor of GlobalFoundries, Nvidia stays. Believe me, Nvidia does not pay nearly as much to TSMC as AMD does, they need them to stay at all cost.

its not make sense at all, after all ati right NOW have bigger market share than NVDIA, and have ship more card than nvdia

EDIT: and btw ati is the first partner that use their 40nm process (HD4770) and its take months for nvdia to catch up.

I dont think what I said is that difficult to believe anyway:

1- Ati only uses TSMC mainly for consumer graphics, since it's core logic, professional GPU and HPC markets are really small, whereas Nvidia uses it for GeForce, Quadro, Tesla, Ion and Tegra products all of which vastly outsell AMD competing products except the GeForce in this Quarter. We don't know what will happen in the next quarter, but we do know that in the past Nvidia sold almost twice as much and it's back then when the deals were made*. In regards to the future Ati would certainly have the power to reverse the situation if it weren't because they are leaving. But as I said, deals where made months ago and back then Nvidia had a far greater power to pressure TSMC. They still have, because it is the only big customer that's still 100% loyal, yet.

2- Nvidia's chips were bigger, which means that for the same ammount of cards sold Nvidia ordered many more waffers. Fact of the matter is that the ammount of waffers ordered were probably 3-4 times more for Nvidia. You just cannot talk about a chip being bigger and the disadvantage that it means, without taking into consideration that it also means a small advantage. It's bussiness, after all.

* To clarify, Ati winning this quarter does not and cannot affect previous and current deals. Only future deals can be affected and those are spoiled by the fact AMD is going to GF, no matter what good deals TSMC may offer.Like I said it's actually a little bit smaller. Read the link I provided.

1. you forget one thing, ati is using TSMC for all of its chipset, and they have firepro, firegl line up,

and btw its really affect current deal, because it must increase their capacity in TSMC because its HD 5XXXX selling like hot cakes and right now nvdia don't have any answer for low end DX 11 part where the bulk sales are.

What I have not seen is that article in Nordic HW where it was measured, all I found is this:

www.nordichardware.com/news/71-graphics/40710-geforce-gtx-460-core-revealed.html

Nothing is demostrated, they don't even mention what their measurements are. Not even a ruler or hell even a coin so that we could compare... BSN on the other hand is very specific: 13.7x24.2mm.Like the article I linked said Nvidia is completely dominating 40nm waffers. How many GPUs have been sold this quarter is meaningless. Nvidia didn't have products, hence they didn't sell. Now they have prodcts and they have most of TSMCs capacity. That is what matters. TSMC is going to increase capacity because of both, but mainly Nvidia, obviously, since it's Nvidia who's taking most of the orders currently.

At least they have a die...

Semiaccurate reports the same die size...

Especially, because they are claiming the same size as Semiaccurate I know it's not correct. Semiaccurate... please...

The picture is clearly of a GTX460 768mb.Please,what ? Semiaccurate never had good info ?

Fermi: more than 600 mm^2 -> truth 529 mm^2

GT200b: more than 500 mm^2 -> 470mm^2

G92b: 270 mm^2 -> 231 mm^2

Of course after real numbers are known, they always make a false "I told you" article where they claim to have said the correct numbers. Charlie Demerjian will soon adopt the name Winston Smith, will start working on the Minitrue (Ministry of Truth) and SA may very well start writing their articles in Newspeak.Actually SA is FUD and that NH "article" looks like FUD, since it was obviously created with the only idea of saying SA numbers were true without giving any proof, because... "look it's a cat!". Show me a single Charlie Demerjian article where there's a single proof instead of a link to another SA or INQ article. I'm just asking for one...

i would work it out myself but its 3am and im drunk lol, time for some much needed sleep

Any other method fails miserably and sadly is the other methods like using a ruler or comparative methods (like the one you suggested) which are used by these people. For example a ruler is NOT accurate at all to measure this kind of things and most people don't even know how to properly use a ruler or simply lack the experience or the eyesight (me included). The main problem is from where exactly in the scale you start counting? And where do you end? Are you actually chosing the exact place you wanted to choose, in other words is your eyesight accurate enough? Are you at a 90º angle above both marks? Etc, etc, etc...

The marks are usually 0.5-1 mm thick so you can actually miss the real measurement by as much as 1 mm and that actually happens a lot (subjectiveness also plays a big role in this case, think Charlie measuring). Most people that I have seen in my life, measure by putting the object inscribed between the two lines, which is a fatal error and results in one extra mm. And that's a lot guys. i.e 18x18 = 324, but 19x19 = 361. <<-- BTW isn't the similarity between those two results and the ones at hand with GF104, hmmm... somewhat... telling?

Your key strokes reveal the green rage you have inside.

And yes, the NH die measurements are correct, or I presumed they just measured the die with their fingers? Jesus.

If I throw a GTX460 in the ocean I bet you'll jump in after it so you can save it and caress it with your hands and love it for eternity.

PS: I like that people are actually giving you links to articles, aka real proof, and all you're getting as counterarguments are just words you made up, which you think are solid arguments just because you spewed them on this forum.

EDIT: Now that I had time I searched for a link to support my claims about TSMC. Not the article that I first read, but this should suffice. I never claimed my numbers about TSMC were true anyway, I only claimed to have read them btw. What the actual especific numbers are do not change the fact that my point was valid.

www.digitimes.com/NewsShow/MailHome.asp?datePublish=2010/7/1&pages=PD&seq=207

I was talking about the GF104 die size btw. Because of the sarcasm that didn't transcribe.

GF104 sizes:

techreport.com/articles.x/19242/2 - 320mm^2

www.semiaccurate.com/2010/07/21/gf104gtx460-has-huge-die/ - 367mm^2

Some other sources say: 331mm^2 (lab501 forums)

Nordic Hardware: 366mm^2

And Jesus, people gave you this link:

www.nordichardware.com/news/71-graphics/40710-geforce-gtx-460-core-revealed.html

It leads you directly to the Nordic Hardware news article, or was it so hard to open the link?

And I presume someone who has that kind of machinery lying around is just going to measure the die size with a ruler?

Let me bold this out for you GTX460 die size > HD5870 die size (which means ATI makes more dies / waffer and in the end makes more money)

It was me who posted that link! Jeeeesus! :roll:

me it's me: Benetanegia

<<<<<< this one.

Anyway...

So out from 4 different sources (3 actually since SA and NH is the same in this case), we have to believe the one that says it's bigger. Funny, who is biased??. 320 mm was said by at least TechReport, Xbitlabs and Anandtech and BSN and Fudzilla said 330-340.

By cathegories:

Press:

TedhReport/Anand/Xbit >>>>>>>> Nordic Hardware

Non-press/blogs:

BSN/Fudzilla >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> Semiaccurate

Xbitlabs and the others took the TechReport number for granted.

And if you read the TechReport article carefully, they say that they estimate that the die size is that big.

I believe the original chinese article where they machined the GTX460 heatspreader off and actually measured the die size and they got 366mm^2 (NordicHardware didn't make the measurements, they just reposted what a Chinese website found).

Fudzilla is like a nvidia heaven and Semiaccurate might seem sometimes against NV but what they reported so far isn't far from the truth, in the end, you read what you want.

Anyway, it's not like the die size matters in any way for us the consumers, it just matters for the bottom line of the chip companies.