Wednesday, August 14th 2013

AMD Winner in Q2, Intel Up, NVIDIA Down, According to Jon Peddie Research

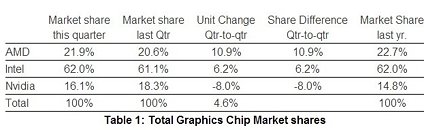

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics chip shipments and suppliers' market share for 2013 2Q. While the news was disappointing year-to-year, the news was encouraging quarter-to-quarter. AMD overall unit shipments increased 10.9%, quarter-to-quarter, Intel increased 6.2%, and Nvidia decreased by 8%. The overall PC market declined 2.5% quarter-to-quarter while the graphics market increased 4.6%. Overall this net 7.1% increase reflects an interest on the part of consumers for double-attach-the adding of a discrete GPU to a system with integrated processor graphics, and to a lesser extent dual AIBs in performance desktop machines.

On a year-to-year basis we found that total graphics shipments during Q2'13 dropped 6.8% while PC shipments which declined by at a faster rate of 11.2% overall. GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped and most of the PC vendors are guiding down to flat for Q3'13. The popularity of tablets and the persistent economic slowness are the most often mentioned reasons for the decline in the PC market and the CAGR for PC graphics from 2012 to 2016 is -1.4%; we expect the total shipments of graphics chips in 2016 to be 319 million units.

The ten-year average change for graphics shipments for quarter-to-quarter is a growth of 7.2%. This quarter is below the average with a 4.6% increase.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), Smartbooks, or ARM-based Servers. It does include x86-based tablets.

The quarter in general

On a year-to-year basis we found that total graphics shipments during Q2'13 dropped 6.8% while PC shipments which declined by at a faster rate of 11.2% overall. GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped and most of the PC vendors are guiding down to flat for Q3'13. The popularity of tablets and the persistent economic slowness are the most often mentioned reasons for the decline in the PC market and the CAGR for PC graphics from 2012 to 2016 is -1.4%; we expect the total shipments of graphics chips in 2016 to be 319 million units.

The ten-year average change for graphics shipments for quarter-to-quarter is a growth of 7.2%. This quarter is below the average with a 4.6% increase.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), Smartbooks, or ARM-based Servers. It does include x86-based tablets.

The quarter in general

- AMD's shipments of desktop heterogeneous GPU/CPUs, i.e., APUs declined 9.6% from Q1 and increased an astounding 47.1% in notebooks. The company's overall PC graphics shipments increased 10.9%.

- Intel's desktop processor-graphics EPG shipments decreased from last quarter by 1.4%, and Notebooks increased by 12.13%. The company's overall PC graphics shipments increased 6.2%.

- Nvidia's desktop discrete shipments were down 8.9% from last quarter; and, the company's mobile discrete shipments decreased 7.1%. The company's overall PC graphics shipments declined 8.0%.

- Year-to-year this quarter AMD overall PC shipments declined 15.8%, Intel dropped 12.9%, Nvidia declined 5.1%, and VIA fell 12.4% from last year.

- Total discrete GPUs (desktop and notebook) were down 5.5% from the last quarter and were down 5.2% from last year for the same quarter due to the same problems plaguing the overall PC industry. Overall the trend for discrete GPUs is up with a CAGR to 2016 of -2.2%.

- Ninety nine percent of Intel's non-server processors have graphics, and over 67% of AMD's non-server processors contain integrated graphics; AMD still ships IGPs.

32 Comments on AMD Winner in Q2, Intel Up, NVIDIA Down, According to Jon Peddie Research

I have had faith in AMD all of these years and I am glad that their purchase of ATI is really starting to create synergy for them after all. They still have a long uphill battle before them just as we all do financially.

Hypothetical example:

Vendor A's shipments rise from 100 million to 101 million. Mere 1% increase, but 1 million units

Vendor B's shipments rise from 100,000 to 150,000. Fantastic 50% increase, but 50K units.

AMD APU's need to up their game to contest their new rival. While from what I've read and seen Nvidia dGPU mobile parts are really starting to be seen as less desirable from a cost/power/thermal design issues for OEM to hold that course. So in coming financials Nvidia will almost certainly watch such products lines wane.

That has to be a shocker.:eek:

In other news:* Xeon Phi costs more ($4100+ versus $3700 for the respective top models) , has lower efficiency, and lower real world performance:

The only area where Xeon Phi would have the advantage is coding, but then, HPC is built around custom code.

Tiahne-2 uses custome 3000 series Xeon Phi. Hardly top of the line actually its the bottom of the line costing $1695.00 msrp.

Accelerator/Co-Processor %

Nvidia K20 = 0.8

Nvidia K20x = 0.6

Intel Xeon Phi 5110P = 0.8

Intel Xeon Phi (Unspecified) = 0.6

Intel Xeon Phi SE10X = 0.4

Intel Xeon Phi 31S1P = 0.2

Intel Xeon Phi SE10P = 0.2

Mixed

K20M / Xeon Phi 5110P = 0.2

Also, a bottom of the line GPGPU that has a 300W TDP...guess that's why the Tiahne-2 doesn't feature anywhere in Performance-per-watt...and co-incidentally why the two most efficient systems are Tesla K20 equippedBTW you seem to be missing both some actual relevancy, both to the thread and whatever the above is supposed to be about. I'd also be more inclined to believe the actual testing.

Intel up and Nvidia down isnt limited to consumer desktop products.

I was pointing out that Intel is doing a great job for its first outing on the HPC supercomputing market that's its being adopted by new and transitioning/upgrading systems just as good and if not better then Nvidia.

The fact that Intel is even making that big of a stride into the HPC market with its MiCs is interesting and reflects the original post in other sectors.

You went on to ramble on performance and power efficiency and my favorite profit margins. WTF!!! does that have to do with market share of any kind in any sector.

You just seam to have your panties in a twist. I guess I would too if I lived my life with Green colored glasses.

As for Xeon Phi, there is certainly a market. But being a new Intel product, Intel will do what it usually does - whatever needs be done to push the industry in the direction that best suits Intel. If Intel basically gives away Xeon Phi (remember the GPU is 15-25% larger than GK 110 with no secondary gaming market to exploit for high priced salvage parts) in order to establish its presence, it's probably a no brainer that some projects are going to take Intel's handouts.

I keep seeing you post excuse after excuse.

AMD is starting to get a foothold with it's APU division and spreading it out as much as possible. Desktops, notebooks, and ultrabooks are just the start of it. They've already got their parts in a few tablets and if they're smart, they will make the move to produce efficient enough APUs that can be featured in smartphones. That is where I think the biggest impact will take place. Now don't get me wrong, if efficiency wasn't a factor and it was boiling all down to price/performance, I think AMD would have an even larger piece of the pie than what they already have now. But since that's not the case, they seem to be making decent strides in regards to efficiency, which is what the market wants. How this all plays out will be dependant mostly on what consumers decide what to do with their new purchases and upgrade paths, what companies decide who to feature in their next big smartphone/tablet, and whether or not their willing to pay for what they are offering.

Servers are a whole other thing which I don't know much about so I won't comment on that aspect of the business. But if they tweak their business model a little bit to work with what data centers put inside their buildings, they can take a good chunk of market share on that end as well. But as always, first, efficiency is the key, then you market the product as best you can.

Nvidia's Shield hasn't really catapulted them as a contender against the other portable systems such as the 3DS and VITA. They have their own specialized market for this thing which I don't think will make them too much money. I haven't read too many reports on post-launch of Shield, but I don't hear anything astonishing about it.

And Intel, well, I don't see anything being radically different on their end. They are delivering like they have always been. We'll see what happens down the road when Broadwell launches. If they can increase the output of their IGP, I think they can be competitive with AMD against their APUs. Intel will most likely continue in the same direction they took with Haswell and improve the GPU further in Broadwell and increase the IPC of the CPU part of it about another ~10 percent.

Now bring us Vulcanic Islands already! :rockout:

I know regional distros can sometime throw up some odd pricing structures, but Newegg has the 760 at ~$250 while the 7970GE is still closer to $300than $250.

Not saying that your scenario isn't valid, just enquiring what locale you're buying from. Locally, I have weird pricing structures also ( FX-9590 being $50 more expensivethan a 3970X for instance, and the 7970GE is ~20% more expensive than the comparable model 760- EVGA is slightly cheaperstill)

From what you're saying, you seem to intimating that you have definite proof of at least two of those three factors. Feel free to share this knowledge.Well, that's the way of all things GPU related. Nvidia's cards are probably overdue for a price cut since the 7970's (and stillborn 7990) overly long tenure as AMD's flagship has extended the Titan/GTX 780's inflated pricing past what would be the norm. As for devaluing the entire Nvidia lineup that depends on what AMD release...and when. Hopefully a lot and soon, because if you think that a single price drop of the halo parts would "butcher" Nvidia's market (hint: it probably wouldn't. Nv could still likely lop $100 off the 780 and $300 off the Titan and still not affect those SKU's under them), then AMD must have already been butchered, wrapped, cooked up and had a fork stuck in it after cuts in April 2012...July 2012...September 2012...and of course the further price cuts for the 7970GE and 7990I think you'll find that the pro graphics Quadro and Tesla market offer the highest margins, and substantially higher returns as a division than do the combined GTX 780/Titan sales....especially if this price is to be believed