Friday, January 18th 2019

TSMC's 7 nm Fabrication Becomes Biggest Share of Revenue in 4Q18

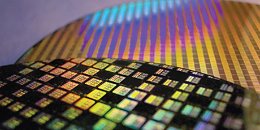

TSMC's introduction of its 7 nm fabrication technology has essentially propelled the company to silicon manufacturing heights. Every company - particularly in the mobile space - is after the most minute increase in transistor density and power consumption improvements the latest and greatest can bring. AMD themselves have become a major TSMC partner in pursuit of its newfound competitiveness against Intel, and has apparently leveraged the 7 nm process as a way to keep its high-performance GPU offering minimally competitive with NVIDIA's solution - at a much lesser die area requirement, if the Radeon VII vs RTX 2080 estimates are something to go by.

As a consequence of the market interest for the 7 nm process, it has rapidly become TSMC's biggest revenue generator as soon as 4Q18. The company said that 7 nm already generated 10% of the company's entire 2018 revenue, despite the process only having been ramped up in June of the same year. Other less dense technologies still generate a lot of revenue for the company, and are likely much higher volume. However, TSMC is most likely riding on much increased ASP for 7 nm wafers than for other technologies.

As a consequence of the market interest for the 7 nm process, it has rapidly become TSMC's biggest revenue generator as soon as 4Q18. The company said that 7 nm already generated 10% of the company's entire 2018 revenue, despite the process only having been ramped up in June of the same year. Other less dense technologies still generate a lot of revenue for the company, and are likely much higher volume. However, TSMC is most likely riding on much increased ASP for 7 nm wafers than for other technologies.

9 Comments on TSMC's 7 nm Fabrication Becomes Biggest Share of Revenue in 4Q18

It's more like AMD needs TSMC, just as much as TSMC needing AMD to keep their fabs running at full capacity utilization. It's unlikely that TSMC will have too much wiggle room to lower their prices. Don't forget they'll update 7nm with EUV, then march towards 5nm & 3nm with increased R&D spending. If the rest of the industry isn't paying as much for this, then AMD will have to pay some of the tab.

Long timeno see!....Looks like AMD bet everything on 7nm and it's starting to pay off.

That's AMD's other big piece... all culminating the HPC, AI, Deep-Learning, Cloud, Datacenter/Server markets. All that is booming and AMD is right out in front in those hugely lucrative markets.

www.thestreet.com/investing/amd-plans-for-battling-intel-and-nvidia-in-data-center-14771526

Alright I am convinced TPU is intentionally trolling at this point. That, or that GPP really does force them to shill once a day.I mean if you think about it AMD has been making "educated guesses" for a decade. First 6-core, stripped-down multicore (bulldozer), Async, DX12, crossfire, etc.

They have to get it right a few times.... and it has almost destroyed them before. Lisa Su seems especially adept at knowing which ones are the right bet though, which is good.