Monday, January 28th 2019

NVIDIA Revises Financial Outlook for 2019 by $500 million, Immediately Hit Back by the Stock Market

NVIDIA's stock value has been falling precipitously in the last several months. We reported in December that the company lost some 48.8% in value between October and December, moving from an all-time peak of $289.36 on October 1st, to just under $149 on December 14th. At the time, excess inventories were the cause, alongside a less than glamorous reception to their new RTX series of graphics cards. Now? NVIDIA cites "deteriorating macroeconomic conditions, particularly in China" as harming demand for their gaming GPUs. But this now comes alongside a its datacenter business also falling short of expectations - that's two of NVIDIA's most lucrative markets being put towards the red, or at least, with lower than expected income revenues.

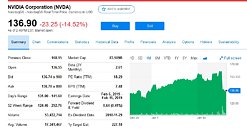

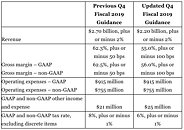

This led the company to revise its financial outlook for the year, lowering revenue estimates by $500 million, down to $2.2 billion from its initial $2.7 billion forecast. Gross margins have been lowered by some 7%, which means lowered earnings for investors. Since the December plunge, NVIDIA's stock had recovered up to around $160 per share, but has now dived 14.52%, down to $136.90 - even lower than before. The company has seen its market valuation shrink by more than 50% inside of four months - while the company is still well in the green side of the limbo, so to speak, these certainly don't serve to improve the company's spirit.

Source:

Yahoo Finance

This led the company to revise its financial outlook for the year, lowering revenue estimates by $500 million, down to $2.2 billion from its initial $2.7 billion forecast. Gross margins have been lowered by some 7%, which means lowered earnings for investors. Since the December plunge, NVIDIA's stock had recovered up to around $160 per share, but has now dived 14.52%, down to $136.90 - even lower than before. The company has seen its market valuation shrink by more than 50% inside of four months - while the company is still well in the green side of the limbo, so to speak, these certainly don't serve to improve the company's spirit.

55 Comments on NVIDIA Revises Financial Outlook for 2019 by $500 million, Immediately Hit Back by the Stock Market

Still 30% too much.

Yes, they do a lot of things, but you have to remember that:

a) they often often sell them bundled (e.g. servers with OS, database software and services),

b) they sell to enterprises.

By comparison, Nvidia may only make chips, but they sell it to everyone: gamers, notebooks buyers, datacenters, scientific institutions, car makers and so on.

And yeah... Nvidia is practically a monopolist (especially in computation), which does help as well. IBM is not that important anymore - they're not making anything unique or essential.

...except the fact that the dude, somehow, doesnt know that gpuz reads the memory type. That speaks volumes of the bbn knowledge base he has.

Stop propagating this vid... OFN at best...clickbait at worst.

Ngreedia.

I mean: with mining off the table and prices lower than Nvidia's, are they still making money in the PC GPU segment? Is it worth the fuss?

I still wish (and need) AMD to be competitive, but it's been years since I've been in "I'll believe it when I see it" mode.

Edit - just to add here, the last bit of your post is also incorrect. Here's a few snippets I pulled off of stackexchange that will help you understand why the stock price actually does impact the company, if the article here on TPU and it's clear title didn't do already do that. It's not usually an immediate impact, more of a "downstream" effect so-to-speak. I've had a considerable amount of money invested in the stock market for decades. :)