Monday, May 20th 2019

After a 4 Year Leave, AMD Rejoins the Fortune 500 List

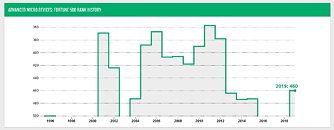

The Fortune 500 lists the top 500 companies in the worold in terms of revenue. These are the most significant movers in the markets, be it of real estate, mining, hedge fund, or semiconductor nature (among others). AMD was "kicked" out of the Fortune 500 back in 2015, when the company was struggling with its Bulldozer-based processors and had an increasingly small marketshare - and thus revenue - that Zen came on to save. Now, thanks to the efforts of everyone involved in the company, they've been listed again on the #460 spot.

The company has been winning minds and wallets when it comes to their CPU solutions in both the mainstream and professional segments, with the company making very important forays into the HPC world mostly thanks to the strength of their CPU lineup - which, in some cases, like with the Frontier Supercomupter (expected to be the world's fastest), can bring wins in the GPU computing department as well. For comparison's sake, Intel stands at a commanding #43, while NVIDIA enjoys a comfortable #268 place.

Source:

Fortune 500

The company has been winning minds and wallets when it comes to their CPU solutions in both the mainstream and professional segments, with the company making very important forays into the HPC world mostly thanks to the strength of their CPU lineup - which, in some cases, like with the Frontier Supercomupter (expected to be the world's fastest), can bring wins in the GPU computing department as well. For comparison's sake, Intel stands at a commanding #43, while NVIDIA enjoys a comfortable #268 place.

28 Comments on After a 4 Year Leave, AMD Rejoins the Fortune 500 List

Back on topic, it's good to see AMD back in this list. Suspect they're going to be there for a while.

Nvidia still isn't using 7nm either meaning they can easily take their already competitive lineup and shrink it once its mature.

Still its good to see AMD doing well again.

Semantics aside, my point stands.

I worry what the flatat earthers will think

I feel bad for abandoning raevenlord to the newsfeed right now. Typos like this are a clear sign of working too fast, for whatever reason. I think he's one of the better writers though, just needs to watch his time management maybe. Kudos dude.

good to see AMD as one of the real big boys again

They are all Zen2 + Navi .

I just removed my pants.

Edit:

Tried googling a little, focused on first quarter of calendar year 2019 and consumer side of things:

AMD: ir.amd.com/static-files/64fc9ab8-d846-49c9-8dda-371e53a34552

$831M from Computing and Graphics (which seems to be mainstream segment considering enterprice/datacenter is listed separately), $1272M total.

Gross Margin 41%, this is surely lower in Computing and Graphics. Upwards trend.

Nvidia: s22.q4cdn.com/364334381/files/doc_financials/quarterly_reports/2020/Q120/Q1FY20-CFO-Commentary.pdf

This says Nvidia GPU business was $2B in Q1FY20, Gaming "market platform" is about $1B of this.

Overall Gross Margin is 59%, again, this is surely lower in the Gaming part of things with a downwards trend.

Intel: s21.q4cdn.com/600692695/files/doc_financials/2019/Q1/Q1-2019_EarningsRelease_Final.pdf

Client Computing Group $7.8B, but this includes a lot more than just processors and PCHs. Wifi, cellular, Thunderbolt and mobile stuff.

Overall gross margin 56.6%, lower in consumer things as usual, trend strongly downwards.

AMD Data Center, Embedded and Semi-custom revenue (that includes both servers as well as consoles) is a little over 50% of what Computing and Graphics segment brings in.

For comparison, Nvidia gets 60% from Data Center (Teslas) and additional 25% from Professional Visualization (Quadro). This is revenue as percentage of Gaming segment revenue. Intel gets about 57% from Data Center (with downward trend). Again, revenue as percentage of Client Computing Group revenue.

Unfortunately 'Computing and Graphics' is a very blanket/general term. I believe I've seen unit count numbers in reports in the past, maybe through HardOCP (RIP and damn Intel for killing off a damn good source of news). The challenge is putting a dollar price on the total unless they have a report with that break down too?

Obviously with the report you linked to they are slowly knocking down the debt and increasing their R&D costs. There isn't any way around it, they've got a ways to go. At the end of the day when I'm in a position to upgrade my GPU I'm going to buy the best I can with the money that I have which almost always is AMD. Liquid cooling is a must at this point though and I'd love to see upper-midrange and up to include at least some models. Plus I see way too many "high end" cards sporting part or even full aluminum heatsinks plus the fins point to the side instead of moving the heat out to the back of the case.

The problem with market share is mindset. Unfortunately most people don't use their brains for critical thinking. In example if Nvidia has the fastest video card then a very disproportionate percent of the market will buy a $100 GPU from Nvidia with 40% less performance than AMD because they're reading benchmarks for $800+ cards. The Radeon VII card isn't bad from the benchmarks middling between the 2070 and 2080 and people act like it's some great disappointment. I think HBM2 has it's place though realistically once AMD has more of a budget to work with I'm sure we'll see GDDR6 and HBM2 high end cards come out at the same time. Plus people doing video editing think 16GB cards are a boon since they keep running out of GPU memory on other cards (and Nvidia's wacky RAM numbers just make my roll my eyes, 11GB? Seriously?). So many people act like it's disappointment, doom and gloom but I don't see them standing in David's shoes fighting against a Goliath. AMD is still securing their place in the market, the only difference now though is that they have more of a long term grip on things.