Thursday, April 23rd 2020

Intel Reports First-Quarter 2020 Financial Results

Intel Corporation today reported first-quarter 2020 financial results. "Our first-quarter performance is a testament to our team's focus on safeguarding employees, supporting our supply chain partners and delivering for our customers during this unprecedented challenge," said Bob Swan, Intel CEO."The role technology plays in the world is more essential now than it has ever been, and our opportunity to enrich lives and enable our customers' success has never been more vital. Guided by our cultural values, competitive advantages and financial strength, I am confident we will emerge from this situation an even stronger company."

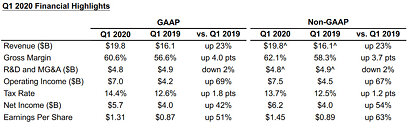

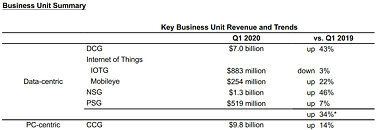

In the first quarter, Intel achieved 34 percent data-centric revenue growth and 14 percent PC-centric revenue growth YoY. The company maintained essential factory operations with greater than 90 percent on-time delivery while supporting employees, customers and communities in response to the COVID-19 pandemic. This includes a new Intel Pandemic Response Technology Initiative to combat the virus where we can uniquely make a difference with Intel technology, expertise, and resources.First-quarter data-centric results were led by strength in the Data Center Group (DCG) with revenue up 43 percent YoY driven by broad strength including 53 percent YoY growth in cloud service provider revenue. Intel's memory business (NSG) and Mobileye both set new revenue records in the first quarter. Also, Intel introduced a broad, data-centric portfolio for 5G network infrastructure, including the new Intel Atom P5900, a 10 nm system-on-chip (SoC) for wireless base stations; a next-generation structured ASIC for 5G network acceleration (code-named "Diamond Mesa"); and new 2nd Gen Intel Xeon Scalable processors.

The PC-centric business (CCG) exceeded expectations, up 14 percent YoY in the first quarter on improved CPU supply and demand strength as consumers and businesses are relying on PCs for working and learning at home. Recently, Intel launched the 10th Gen Intel Core H-series mobile processors, including a new processor delivering desktop-caliber performance that gamers and creators can take anywhere.

Additional information regarding Intel's results can be found in the Q1'20 Earnings Presentation available at: www.intc.com/results.cfm

Business Outlook

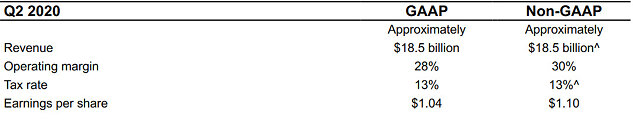

Intel's guidance for the second-quarter includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below. Given the significant economic uncertainty,Intel is not providing full-year guidance. Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after April 23, 2020.

In the first quarter, Intel achieved 34 percent data-centric revenue growth and 14 percent PC-centric revenue growth YoY. The company maintained essential factory operations with greater than 90 percent on-time delivery while supporting employees, customers and communities in response to the COVID-19 pandemic. This includes a new Intel Pandemic Response Technology Initiative to combat the virus where we can uniquely make a difference with Intel technology, expertise, and resources.First-quarter data-centric results were led by strength in the Data Center Group (DCG) with revenue up 43 percent YoY driven by broad strength including 53 percent YoY growth in cloud service provider revenue. Intel's memory business (NSG) and Mobileye both set new revenue records in the first quarter. Also, Intel introduced a broad, data-centric portfolio for 5G network infrastructure, including the new Intel Atom P5900, a 10 nm system-on-chip (SoC) for wireless base stations; a next-generation structured ASIC for 5G network acceleration (code-named "Diamond Mesa"); and new 2nd Gen Intel Xeon Scalable processors.

The PC-centric business (CCG) exceeded expectations, up 14 percent YoY in the first quarter on improved CPU supply and demand strength as consumers and businesses are relying on PCs for working and learning at home. Recently, Intel launched the 10th Gen Intel Core H-series mobile processors, including a new processor delivering desktop-caliber performance that gamers and creators can take anywhere.

Additional information regarding Intel's results can be found in the Q1'20 Earnings Presentation available at: www.intc.com/results.cfm

Business Outlook

Intel's guidance for the second-quarter includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below. Given the significant economic uncertainty,Intel is not providing full-year guidance. Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after April 23, 2020.

19 Comments on Intel Reports First-Quarter 2020 Financial Results

Since it appears no one cares what they pay for intel products, but they still buy it and only complain about it.

Pretty good income considering shortages, etc. etc.

I'm glad that AMD isn't idle.

I don't think anyone could threaten Intel's position in the SemiCon industry.

Their net income in just one quarter is literally 19x more than what AMD achieved in 2019.

It bought massive shares too.

But Intel cash is in big trouble and nVidia might buy them soon!

Insider sources....

Intel Inside Sources

Just have a look at the other article about the new Gigabyte motherboards. How many models? 30? 40? 50?

Not to mention the limitation we see with Renoir. It's too good to have anything more than a 2060.

With Ryzen 4000 mobile it apears they win on every metric - power draw, single core (well, it matches Intel 10th gen) and multi-core but its no good if partners only have 75 different SKUs compared to Intel's 500. Or if tech media are too lenient with Intel's poor products (I watched Hardware Unboxed laptop review of the latest Intel 8-core 10th gen mobile vs a lappy with the latest Ryzen 4800H and Intel was more expensive, massively slower across about 85% of single core and multicore biased tests and drew significantly more power...yet the conclusion was 'it's not the best, it's disappointing' when they should have said 'absolutely do not buy this'.

The profit AMD are making the last 2 years is abysmal. $200m in one financial year compared to....$20 billion at Intel.

Seriously, where do you think profit comes from?:D

The simple fact is: Intel makes a lot of products in large volumes and knows how to sell them at high prices. That's what you expect from a big, successful business - doesn't matter if it makes CPUs or cheese.

AMD makes less products, has lower production capacity and focuses on less client groups. It will take time for them to rebuild a serious market position.

World doesn't turn around internet reviews. People aren't buying just the single best cheese - especially when there's just enough of that cheese for 5% population.

They buy what they're given at the restaurant, they buy what's in the store downstairs when they're hungry, they buy what has a proper list on ingredients on the box etc.

AMD needs a good distribution network - accompanied by proper, local support in large markets. It needs to be more active in industry and science. It needs a proper product documentation - at least matching ARK.

AMD doesn't have any of that, because for almost a decade it has been sitting in a bunker and designing Zen, while Intel and Nvidia were cementing their market position.

So Zen is great, but AMD became a niche, high-end manufacturer in a mass market.

Intel will catch up eventually and if AMD doesn't rebuild their position from 2000s, they'll be once again left without cash.I instantly wanted to report your comments, but they're both so stupid that I found it hard to phrase a proper and polite reason.

Seriously, what happened here?