China Starts Production of Domestic DRAM Chips

China's semiconductor industry is seeking independence in every sector of its industry, with an emphasis of homemade products for domestic use, especially government facilities, where usage of homegrown products is most desirable. According to the report of China Securities Journal, Chinese firm has started production of DRAM memory.

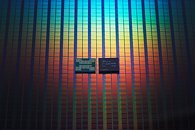

A company named ChangXin Memory Technology, founded in 2016 to boost domestic silicon production, on Monday started production of DRAM memory, aiming to directly replace the current supply of foreign memory from companies like Micron, SK Hynix and Samsung. Being build using 18 nm technology which ChangXin calls "10-nanometer class" node, this DRAM chip isn't too far behind offers from competitors it tries to replace. Micron, Samsung and SK Hynix use 12, 14, and 16 nm nodes for production of their DRAM chips, so Chinese efforts so far are very good. The company promises to produce around 120.000 wafers per month and plans to deliver first chips by the end of this year.

A company named ChangXin Memory Technology, founded in 2016 to boost domestic silicon production, on Monday started production of DRAM memory, aiming to directly replace the current supply of foreign memory from companies like Micron, SK Hynix and Samsung. Being build using 18 nm technology which ChangXin calls "10-nanometer class" node, this DRAM chip isn't too far behind offers from competitors it tries to replace. Micron, Samsung and SK Hynix use 12, 14, and 16 nm nodes for production of their DRAM chips, so Chinese efforts so far are very good. The company promises to produce around 120.000 wafers per month and plans to deliver first chips by the end of this year.