SiFive Secures $61 Million in Series E Funding Led by SK Hynix

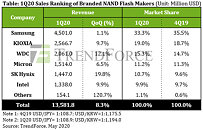

SiFive, Inc., the leading provider of commercial RISC-V processor IP and silicon solutions, today announced it raised $61 million in a Series E round led by SK hynix, joined by new investor Prosperity7 Ventures, with additional funding from existing investors, Sutter Hill Ventures, Western Digital Capital, Qualcomm Ventures, Intel Capital, Osage University Partners, and Spark Capital.

"Global demand for storage and memory in the data center is increasing as AI-powered business intelligence and data processing growth continues", said Youjong Kang, VP of Growth Strategy, SK hynix. "SiFive is well-positioned to grow with opportunities created from data center, enterprise, storage and networking requirements for workload-focused processor IP."

"Global demand for storage and memory in the data center is increasing as AI-powered business intelligence and data processing growth continues", said Youjong Kang, VP of Growth Strategy, SK hynix. "SiFive is well-positioned to grow with opportunities created from data center, enterprise, storage and networking requirements for workload-focused processor IP."