Friday, August 4th 2017

AMD RX Vega Mining Performance Reportedly Doubled With Driver Updates

Disclaimer: take this post with a bucket of salt. However, the information here, if true, could heavily impact AMD's RX Vega cards' stock at launch and in the subsequent days, so, we're sharing this so our readers can decide on whether they want to pull the trigger for a Vega card at launch, as soon as possible, or risk what would seem like the equivalent of a mining Black Friday crowd gobbling up AMD's RX Vega models' stock. Remember that AMD has already justified delays for increased stock so as to limit the impact of miners on the available supply.

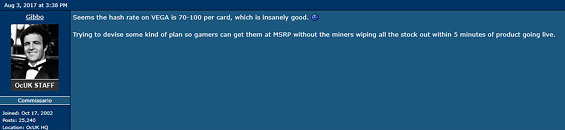

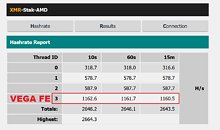

The information has been put out by two different sources already. The first source we encountered (and which has been covered by some media outlets solo) has been one post from one of OC UK's staff, Gibbo, who in a forum post, said "Seems the hash rate on VEGA is 70-100 per card, which is insanely good. Trying to devise some kind of plan so gamers can get them at MSRP without the miners wiping all the stock out within 5 minutes of product going live."The fact that a staffer from OC UK is actually looking for ways to prevent miners from wiping the stock speaks more to the credence of the information than the "70-100 hash rate" claim. Apparently, this information was conveyed to Gibbo from an AMD AIB partner, who remains unknown at time of writing. This information has already been sort of confirmed by a second source, coming out of Videocardz's Why Cry. In a post, the editor reported how he already had come in possession of similar information through his sources, who put the hash rate of RX Vega close to double that of the Frontier Edition's original hash rate, which was ~30 MH/s in Ethereum mining. This means the hash rate could be ~60 mark, which is still close to OC UK's Gibbo's reference to a "70-100" hash rate. This increase in hash rate was apparently indirectly enabled by updated driver features for the RX Vega cards. Apparently, these were included in the drivers to improve features and gaming performance - which also indirectly resulted in increased mining capabilities.

We had already covered in our Vega Architecture Technical Overview article that AMD's Vega NGCU computation capabilities were bolstered through added support for over 40 new ISA instructions, which result in increased IPC over Polaris - and which were also mentioned by VSG at the time as being "very relevant for GPU mining."Adding to this story is the fact that recent optimizations from a Reddit user to a Monero mining program and an underclock to 1.3 GHz have brought the Frontier Edition's mining hashrates to around 1.16 kH/s - 34% faster than a GeForce GTX 1080 Ti (around 0.76 kH/s according to Nicehash), and 43% faster than a single Radeon RX 580 8 GB. This means that the $999 Frontier Edition currently stands at double the mining performance of the GTX 1080 on Monero - and the gaming RX Vega, with its $499 price-tag, should follow suit. And these are optimizations achieved by a single user, for a cryptocurrency that is admittedly not as popular as Ethereum or others. But increasing levels of performance in some mining algorithms really does leave the door open for exploration of improved speeds on others, and you can rest assured that miners will, at the very least, attempt to achieve these optimizations in other cryptocurrencies.All in all, if true, these reports lend credence to AMD's take on the RX Vega delays for stock build-up. And the situation seems to be less straightforward than one might hope when it comes to disabling these instructions, or only enabling them at a latter date, after gamers had already had some time to purchase their desired cards. Because these driver-level updates were apparently done with the intent to bolster gaming performance, I believe it's safe to assume AMD can't easily neuter the mining improvements without putting the increased gaming performance at risk as well. Let's see how this pans out, but consider yourselves at least warned - the RX Vega may see much reduced stock and increased pricing throughout if this scenario pans out. in the meantime, those Radeon Packs with both their shortcomings and opportunities are looking like an increasingly interesting way to get ahold of one of AMD's latest...

Sources:

OCUK's Gibbo, Videocardz, NAG, Dirtbagdh @ Reddit

The information has been put out by two different sources already. The first source we encountered (and which has been covered by some media outlets solo) has been one post from one of OC UK's staff, Gibbo, who in a forum post, said "Seems the hash rate on VEGA is 70-100 per card, which is insanely good. Trying to devise some kind of plan so gamers can get them at MSRP without the miners wiping all the stock out within 5 minutes of product going live."The fact that a staffer from OC UK is actually looking for ways to prevent miners from wiping the stock speaks more to the credence of the information than the "70-100 hash rate" claim. Apparently, this information was conveyed to Gibbo from an AMD AIB partner, who remains unknown at time of writing. This information has already been sort of confirmed by a second source, coming out of Videocardz's Why Cry. In a post, the editor reported how he already had come in possession of similar information through his sources, who put the hash rate of RX Vega close to double that of the Frontier Edition's original hash rate, which was ~30 MH/s in Ethereum mining. This means the hash rate could be ~60 mark, which is still close to OC UK's Gibbo's reference to a "70-100" hash rate. This increase in hash rate was apparently indirectly enabled by updated driver features for the RX Vega cards. Apparently, these were included in the drivers to improve features and gaming performance - which also indirectly resulted in increased mining capabilities.

We had already covered in our Vega Architecture Technical Overview article that AMD's Vega NGCU computation capabilities were bolstered through added support for over 40 new ISA instructions, which result in increased IPC over Polaris - and which were also mentioned by VSG at the time as being "very relevant for GPU mining."Adding to this story is the fact that recent optimizations from a Reddit user to a Monero mining program and an underclock to 1.3 GHz have brought the Frontier Edition's mining hashrates to around 1.16 kH/s - 34% faster than a GeForce GTX 1080 Ti (around 0.76 kH/s according to Nicehash), and 43% faster than a single Radeon RX 580 8 GB. This means that the $999 Frontier Edition currently stands at double the mining performance of the GTX 1080 on Monero - and the gaming RX Vega, with its $499 price-tag, should follow suit. And these are optimizations achieved by a single user, for a cryptocurrency that is admittedly not as popular as Ethereum or others. But increasing levels of performance in some mining algorithms really does leave the door open for exploration of improved speeds on others, and you can rest assured that miners will, at the very least, attempt to achieve these optimizations in other cryptocurrencies.All in all, if true, these reports lend credence to AMD's take on the RX Vega delays for stock build-up. And the situation seems to be less straightforward than one might hope when it comes to disabling these instructions, or only enabling them at a latter date, after gamers had already had some time to purchase their desired cards. Because these driver-level updates were apparently done with the intent to bolster gaming performance, I believe it's safe to assume AMD can't easily neuter the mining improvements without putting the increased gaming performance at risk as well. Let's see how this pans out, but consider yourselves at least warned - the RX Vega may see much reduced stock and increased pricing throughout if this scenario pans out. in the meantime, those Radeon Packs with both their shortcomings and opportunities are looking like an increasingly interesting way to get ahold of one of AMD's latest...

216 Comments on AMD RX Vega Mining Performance Reportedly Doubled With Driver Updates

Hoops to jump through but is it doable?

AMD doesn't make shit, the retailers do, the MSRPs are already set.

I suppose you were LOLing at yourself.

They have a more or less fixed amount of wafers they can use per yearly contract , if they want more they have to pay more , at which point they start getting diminishing returns. This is what actually fucks up the pricing and availability , you would think they would pump out as many cards as possible but that's not how it works. They simply can't afford to sell an unlimited amount of cards.

I hope AMD is indeed stocking up big time.

It is in AMD's best interest to sell more cards. If cards are selling out, the should just produce more cards, not nerf their usefulness. Man I am glad a lot of the people here aren't in charge of businesses lol

But really, what will happen if ETH value never goes down to being unprofitable, and ASIC like hardware never made for ETH ? If that stuff is reaching bitcoin value, Nvidia being the only accessible option for gaming will do no good. I think that they may really need to make compute cards optimized for mining at a price so attractive, that miners won't touch the gaming gpu at all.

Pretty much what miners do.

As for ASIC's... NOPE. Ethereum uses a near perfect mininig algorithm that scales up requirements over time, and makes almost full use of every part of a GPU. The closest thing one could ever get to an Ethereum ASIC is literally Vega lol.

And because of the nature of the mining business, they isn't a single partner who want to flood the market with GPU. One of the reason for the The video game krach of 1983 was that they didn't expected the trend to slow down. The market was overflooded with games that nobody would buy. So yhea, while the mining craze is alive making more gpu may looks like a profit, if it's going down the backlash will be hard.

FWIW, you yourself constantly berate Nvidia for Pascal being a Maxwell refresh but it's bloody good business, so I suppose it is good neither you nor I are in charge. You'd make Nvidia less profitable and I'd try to help the gamers.

If the price stayed at MSRP, the makers would make a killing rather than the gougers.

forum.beyond3d.com/threads/amd-vega-hardware-reviews.60246/page-31#post-1994478

Nv's margains on that 314mm2 chip must already be pretty great, but luckily they got the cards out to gamers long ago.

www.newegg.com/Product/Product.aspx?Item=N82E16814126133

www.newegg.com/Product/Product.aspx?Item=N82E16814487263

It's not entirely impossible to make "mining cards" while protecting your exposure to risk. For instance I would recommend AMD make a Vega48 card with 4GB of HBM, lower clocks, a 30-day warranty, and only 2 display outputs for $350. This card would consist of AMD's absolute worst HBM and 14nmGF yields. Most gamer with half a brain would know it is worth the extra $50 to get more VRAM and 10% higher performance, but this card would be just as good for miners. More importantly though, if the mining market went through a "bust" period: AMD could simply drop the price to $299 and sell the card as a dirt cheap alternative to 1080p gamers with only 2 displays (And they wouldn't be losing money given the substantially reduced warranty and components).