Friday, August 4th 2017

AMD RX Vega Mining Performance Reportedly Doubled With Driver Updates

Disclaimer: take this post with a bucket of salt. However, the information here, if true, could heavily impact AMD's RX Vega cards' stock at launch and in the subsequent days, so, we're sharing this so our readers can decide on whether they want to pull the trigger for a Vega card at launch, as soon as possible, or risk what would seem like the equivalent of a mining Black Friday crowd gobbling up AMD's RX Vega models' stock. Remember that AMD has already justified delays for increased stock so as to limit the impact of miners on the available supply.

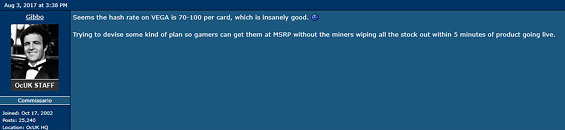

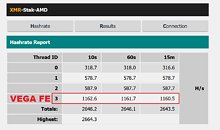

The information has been put out by two different sources already. The first source we encountered (and which has been covered by some media outlets solo) has been one post from one of OC UK's staff, Gibbo, who in a forum post, said "Seems the hash rate on VEGA is 70-100 per card, which is insanely good. Trying to devise some kind of plan so gamers can get them at MSRP without the miners wiping all the stock out within 5 minutes of product going live."The fact that a staffer from OC UK is actually looking for ways to prevent miners from wiping the stock speaks more to the credence of the information than the "70-100 hash rate" claim. Apparently, this information was conveyed to Gibbo from an AMD AIB partner, who remains unknown at time of writing. This information has already been sort of confirmed by a second source, coming out of Videocardz's Why Cry. In a post, the editor reported how he already had come in possession of similar information through his sources, who put the hash rate of RX Vega close to double that of the Frontier Edition's original hash rate, which was ~30 MH/s in Ethereum mining. This means the hash rate could be ~60 mark, which is still close to OC UK's Gibbo's reference to a "70-100" hash rate. This increase in hash rate was apparently indirectly enabled by updated driver features for the RX Vega cards. Apparently, these were included in the drivers to improve features and gaming performance - which also indirectly resulted in increased mining capabilities.

We had already covered in our Vega Architecture Technical Overview article that AMD's Vega NGCU computation capabilities were bolstered through added support for over 40 new ISA instructions, which result in increased IPC over Polaris - and which were also mentioned by VSG at the time as being "very relevant for GPU mining."Adding to this story is the fact that recent optimizations from a Reddit user to a Monero mining program and an underclock to 1.3 GHz have brought the Frontier Edition's mining hashrates to around 1.16 kH/s - 34% faster than a GeForce GTX 1080 Ti (around 0.76 kH/s according to Nicehash), and 43% faster than a single Radeon RX 580 8 GB. This means that the $999 Frontier Edition currently stands at double the mining performance of the GTX 1080 on Monero - and the gaming RX Vega, with its $499 price-tag, should follow suit. And these are optimizations achieved by a single user, for a cryptocurrency that is admittedly not as popular as Ethereum or others. But increasing levels of performance in some mining algorithms really does leave the door open for exploration of improved speeds on others, and you can rest assured that miners will, at the very least, attempt to achieve these optimizations in other cryptocurrencies.All in all, if true, these reports lend credence to AMD's take on the RX Vega delays for stock build-up. And the situation seems to be less straightforward than one might hope when it comes to disabling these instructions, or only enabling them at a latter date, after gamers had already had some time to purchase their desired cards. Because these driver-level updates were apparently done with the intent to bolster gaming performance, I believe it's safe to assume AMD can't easily neuter the mining improvements without putting the increased gaming performance at risk as well. Let's see how this pans out, but consider yourselves at least warned - the RX Vega may see much reduced stock and increased pricing throughout if this scenario pans out. in the meantime, those Radeon Packs with both their shortcomings and opportunities are looking like an increasingly interesting way to get ahold of one of AMD's latest...

Sources:

OCUK's Gibbo, Videocardz, NAG, Dirtbagdh @ Reddit

The information has been put out by two different sources already. The first source we encountered (and which has been covered by some media outlets solo) has been one post from one of OC UK's staff, Gibbo, who in a forum post, said "Seems the hash rate on VEGA is 70-100 per card, which is insanely good. Trying to devise some kind of plan so gamers can get them at MSRP without the miners wiping all the stock out within 5 minutes of product going live."The fact that a staffer from OC UK is actually looking for ways to prevent miners from wiping the stock speaks more to the credence of the information than the "70-100 hash rate" claim. Apparently, this information was conveyed to Gibbo from an AMD AIB partner, who remains unknown at time of writing. This information has already been sort of confirmed by a second source, coming out of Videocardz's Why Cry. In a post, the editor reported how he already had come in possession of similar information through his sources, who put the hash rate of RX Vega close to double that of the Frontier Edition's original hash rate, which was ~30 MH/s in Ethereum mining. This means the hash rate could be ~60 mark, which is still close to OC UK's Gibbo's reference to a "70-100" hash rate. This increase in hash rate was apparently indirectly enabled by updated driver features for the RX Vega cards. Apparently, these were included in the drivers to improve features and gaming performance - which also indirectly resulted in increased mining capabilities.

We had already covered in our Vega Architecture Technical Overview article that AMD's Vega NGCU computation capabilities were bolstered through added support for over 40 new ISA instructions, which result in increased IPC over Polaris - and which were also mentioned by VSG at the time as being "very relevant for GPU mining."Adding to this story is the fact that recent optimizations from a Reddit user to a Monero mining program and an underclock to 1.3 GHz have brought the Frontier Edition's mining hashrates to around 1.16 kH/s - 34% faster than a GeForce GTX 1080 Ti (around 0.76 kH/s according to Nicehash), and 43% faster than a single Radeon RX 580 8 GB. This means that the $999 Frontier Edition currently stands at double the mining performance of the GTX 1080 on Monero - and the gaming RX Vega, with its $499 price-tag, should follow suit. And these are optimizations achieved by a single user, for a cryptocurrency that is admittedly not as popular as Ethereum or others. But increasing levels of performance in some mining algorithms really does leave the door open for exploration of improved speeds on others, and you can rest assured that miners will, at the very least, attempt to achieve these optimizations in other cryptocurrencies.All in all, if true, these reports lend credence to AMD's take on the RX Vega delays for stock build-up. And the situation seems to be less straightforward than one might hope when it comes to disabling these instructions, or only enabling them at a latter date, after gamers had already had some time to purchase their desired cards. Because these driver-level updates were apparently done with the intent to bolster gaming performance, I believe it's safe to assume AMD can't easily neuter the mining improvements without putting the increased gaming performance at risk as well. Let's see how this pans out, but consider yourselves at least warned - the RX Vega may see much reduced stock and increased pricing throughout if this scenario pans out. in the meantime, those Radeon Packs with both their shortcomings and opportunities are looking like an increasingly interesting way to get ahold of one of AMD's latest...

216 Comments on AMD RX Vega Mining Performance Reportedly Doubled With Driver Updates

Graphics cards possess immense processing power for the money, and it was inevitable they would inflate in price once applications started to make good use of their processing power. Nvidia has been trying to increase GPU prices for years simply because they are sick and tired of selling a 1080 for $500 when the professional version is being sold for $2000!

AMD didn't have the mindshare to demand higher prices, but now their cards are also finally being utilized for business purposes.

Yup , spot on.

So you told me I am wrong , fair enough. Now how tell me why , because what you said is extremely vague at best and does not count as an argument in all fairness. Not even as much as "tunnel vision argument" and you know it.

Other than that if they have a logic processor that happens to be better than the competition at calculating certain loads due to architecture and higher accuracy during specific computation workloads.... people will buy them and retailers will gouge buyers.

Why doesn't someone blame Nvidia for their mediocre performance per dollar? How about their love of substituting lower accuracy for higher performance unless its explicitly stated the pipeline must remain at 16 or 32 bit? How come no one makes a new ASIC that outperforms everyone elses?

Learn to multi-quote people.I read somewhere (maybe the back of a bus shelter) that some crypto-currencies are scripted so as not be readily ASIC mined, i.e. the ASIC miners have had their day to stop mass corporations mining for profit. This maybe why the run on AMD for mining has been so unbelievably strong as the ASIC rigs are out in the cold.

Look I get why people are frustrated, but there really is no one out there to blame. The only blame I can think of is to be annoyed that this surprised AMD/Nvidia yet again.

This is like the 3rd time their cards have sold out due to miners, and to be surprised by the THIRD time something has happened is completely ridiculous.

We cant be mad at either of them IMO.

Geforce and radeon are mainly entertainement tool that can also be used for compute. Gaming card can do compute task just fine, but the developement of their driver isn't made with optimisation for the lastest rendering engine, or the lastest 3d software, it's focalised on games. You want a quick fix for a bug in maya ? You gotta buy a quadro or a radeon pro.

Both Nvidia and AMD have compute unit that were made from the ground up for heavy processing 24/24 7/7 for several years. But the average joe don't buy them, he can't afford it. Instead he's buying stuff that was meant for entertainement. And the demamd is higher than what the factory can put out. Hell even without miners, we already had issue with stock because manufacturing silicon becomes harder and harder. Mining need to have specific hardware that is cheap to make and got a low energy cost.

I'm also doing video edititing 3d rendering/compositing with my pc. So I was really glad to see opencl, cuda, bring more speed for those kind of task.

But for me mining doesn't hold the same value. Mining isn't something that you can enjoy on the long term with a single gpu, the more people that get on the band wagon, the more power it require. Mining hunger is growing way faster than the technology it's using. ETH is the cause of unprecedented energy drain.

Good thing laptop are not concerned by all of this. If their price had to increase because of all this we would have reached total insanity.

40k USD at the moment, but constantly falling, for a super noisy, high maintenance, high risk fire hazard in your basement or garage is a gold mine?

And as with all the other cryptocurrencies, by the time it's mentioned in public it's really too late to earn any real money mining. The ones making a real profit are the ones who mined thousands of coins when it was easy and unknown. You are going to earn less for every single new miner and every single new coin that's found, that sounds like a pretty bad investment.

It's not that hard to make a couple thousands bucks a month dealing in collectibles such as stamps, old video games, etc. But before you think you can make a living from such activities, you should take a closer look at what you'll earn per hour reliably…This will not go on forever.

And there is no guarantee that the cards you buy now will be good for any kind of mining for the next years. And it's not like these cards last for many years when doing mining 24-7.

like say if I had just 4 580' going in whatever coin that's "in atm" any ballpark number on monthly profits?

@cdawall you got any 1070s with micron RAM? If so, what's your memory offset and power target for them?

But make no mistake, even the most crazy mining rush will not be enough to make a good profit for AMD. I did my bitcoin mining before the big GPU rush there, but even that big GPU rush did not make a real impact on AMD's market position nor AMD's profits. Even if AMD managed to ship enough Vegas to meet any demand, the mining market is ultimately "capped", since each new coin makes it less profitable. Even with constantly new currencies, the demand for such GPUs are fairly limited over time. If Vega turns out to be 2-3× better at mining than current cards, that's just going accelerate the rush until it becomes unprofitable.

And the EU is a Very Big market ( with consumer Protection Clout )

THAT is what I consider a gold mine ... free money for very little work. Actually that would be BETTER than a gold mine as real mining is pretty hard on one's body. ;)

I don't care about vega, even the msrp would be above my budget. what really annoy me is how it's reaching even budget oriented market, and the incertitude about when it's going to settle down.

As a side income it's OK but at that point it as far as it can get form a gold mine.

As a side income it all depends what you are willing to invest. If you were to drop 100K into this yes it would a gold mine.

My point is that this is really difficult to get into for most people and make a living out of it. Not a smart idea either.