Friday, August 4th 2017

AMD RX Vega Mining Performance Reportedly Doubled With Driver Updates

Disclaimer: take this post with a bucket of salt. However, the information here, if true, could heavily impact AMD's RX Vega cards' stock at launch and in the subsequent days, so, we're sharing this so our readers can decide on whether they want to pull the trigger for a Vega card at launch, as soon as possible, or risk what would seem like the equivalent of a mining Black Friday crowd gobbling up AMD's RX Vega models' stock. Remember that AMD has already justified delays for increased stock so as to limit the impact of miners on the available supply.

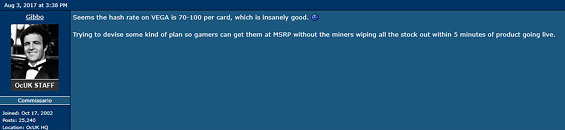

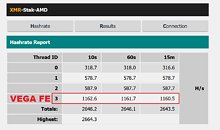

The information has been put out by two different sources already. The first source we encountered (and which has been covered by some media outlets solo) has been one post from one of OC UK's staff, Gibbo, who in a forum post, said "Seems the hash rate on VEGA is 70-100 per card, which is insanely good. Trying to devise some kind of plan so gamers can get them at MSRP without the miners wiping all the stock out within 5 minutes of product going live."The fact that a staffer from OC UK is actually looking for ways to prevent miners from wiping the stock speaks more to the credence of the information than the "70-100 hash rate" claim. Apparently, this information was conveyed to Gibbo from an AMD AIB partner, who remains unknown at time of writing. This information has already been sort of confirmed by a second source, coming out of Videocardz's Why Cry. In a post, the editor reported how he already had come in possession of similar information through his sources, who put the hash rate of RX Vega close to double that of the Frontier Edition's original hash rate, which was ~30 MH/s in Ethereum mining. This means the hash rate could be ~60 mark, which is still close to OC UK's Gibbo's reference to a "70-100" hash rate. This increase in hash rate was apparently indirectly enabled by updated driver features for the RX Vega cards. Apparently, these were included in the drivers to improve features and gaming performance - which also indirectly resulted in increased mining capabilities.

We had already covered in our Vega Architecture Technical Overview article that AMD's Vega NGCU computation capabilities were bolstered through added support for over 40 new ISA instructions, which result in increased IPC over Polaris - and which were also mentioned by VSG at the time as being "very relevant for GPU mining."Adding to this story is the fact that recent optimizations from a Reddit user to a Monero mining program and an underclock to 1.3 GHz have brought the Frontier Edition's mining hashrates to around 1.16 kH/s - 34% faster than a GeForce GTX 1080 Ti (around 0.76 kH/s according to Nicehash), and 43% faster than a single Radeon RX 580 8 GB. This means that the $999 Frontier Edition currently stands at double the mining performance of the GTX 1080 on Monero - and the gaming RX Vega, with its $499 price-tag, should follow suit. And these are optimizations achieved by a single user, for a cryptocurrency that is admittedly not as popular as Ethereum or others. But increasing levels of performance in some mining algorithms really does leave the door open for exploration of improved speeds on others, and you can rest assured that miners will, at the very least, attempt to achieve these optimizations in other cryptocurrencies.All in all, if true, these reports lend credence to AMD's take on the RX Vega delays for stock build-up. And the situation seems to be less straightforward than one might hope when it comes to disabling these instructions, or only enabling them at a latter date, after gamers had already had some time to purchase their desired cards. Because these driver-level updates were apparently done with the intent to bolster gaming performance, I believe it's safe to assume AMD can't easily neuter the mining improvements without putting the increased gaming performance at risk as well. Let's see how this pans out, but consider yourselves at least warned - the RX Vega may see much reduced stock and increased pricing throughout if this scenario pans out. in the meantime, those Radeon Packs with both their shortcomings and opportunities are looking like an increasingly interesting way to get ahold of one of AMD's latest...

Sources:

OCUK's Gibbo, Videocardz, NAG, Dirtbagdh @ Reddit

The information has been put out by two different sources already. The first source we encountered (and which has been covered by some media outlets solo) has been one post from one of OC UK's staff, Gibbo, who in a forum post, said "Seems the hash rate on VEGA is 70-100 per card, which is insanely good. Trying to devise some kind of plan so gamers can get them at MSRP without the miners wiping all the stock out within 5 minutes of product going live."The fact that a staffer from OC UK is actually looking for ways to prevent miners from wiping the stock speaks more to the credence of the information than the "70-100 hash rate" claim. Apparently, this information was conveyed to Gibbo from an AMD AIB partner, who remains unknown at time of writing. This information has already been sort of confirmed by a second source, coming out of Videocardz's Why Cry. In a post, the editor reported how he already had come in possession of similar information through his sources, who put the hash rate of RX Vega close to double that of the Frontier Edition's original hash rate, which was ~30 MH/s in Ethereum mining. This means the hash rate could be ~60 mark, which is still close to OC UK's Gibbo's reference to a "70-100" hash rate. This increase in hash rate was apparently indirectly enabled by updated driver features for the RX Vega cards. Apparently, these were included in the drivers to improve features and gaming performance - which also indirectly resulted in increased mining capabilities.

We had already covered in our Vega Architecture Technical Overview article that AMD's Vega NGCU computation capabilities were bolstered through added support for over 40 new ISA instructions, which result in increased IPC over Polaris - and which were also mentioned by VSG at the time as being "very relevant for GPU mining."Adding to this story is the fact that recent optimizations from a Reddit user to a Monero mining program and an underclock to 1.3 GHz have brought the Frontier Edition's mining hashrates to around 1.16 kH/s - 34% faster than a GeForce GTX 1080 Ti (around 0.76 kH/s according to Nicehash), and 43% faster than a single Radeon RX 580 8 GB. This means that the $999 Frontier Edition currently stands at double the mining performance of the GTX 1080 on Monero - and the gaming RX Vega, with its $499 price-tag, should follow suit. And these are optimizations achieved by a single user, for a cryptocurrency that is admittedly not as popular as Ethereum or others. But increasing levels of performance in some mining algorithms really does leave the door open for exploration of improved speeds on others, and you can rest assured that miners will, at the very least, attempt to achieve these optimizations in other cryptocurrencies.All in all, if true, these reports lend credence to AMD's take on the RX Vega delays for stock build-up. And the situation seems to be less straightforward than one might hope when it comes to disabling these instructions, or only enabling them at a latter date, after gamers had already had some time to purchase their desired cards. Because these driver-level updates were apparently done with the intent to bolster gaming performance, I believe it's safe to assume AMD can't easily neuter the mining improvements without putting the increased gaming performance at risk as well. Let's see how this pans out, but consider yourselves at least warned - the RX Vega may see much reduced stock and increased pricing throughout if this scenario pans out. in the meantime, those Radeon Packs with both their shortcomings and opportunities are looking like an increasingly interesting way to get ahold of one of AMD's latest...

216 Comments on AMD RX Vega Mining Performance Reportedly Doubled With Driver Updates

In economics this is called a "bubble", and it doesn't matter what the speculation object is, the phenomenon is exactly the same whether it's a national currency, bitcoin, gold, oil, stock trade, obligations, food, etc. To begin understanding this, I encourage you to read about the Dutch Tulip mania of 1637, once you grasp this you'll see it's the same thing happening in every economic bubble. Whenever there is a bubble, the ones making the real profits are the ones who invested before the rapid price increase. The ones joining in the middle of the mania can get some return on investment, but the ones near the end will always be the ones taking the full hit.

Each bubble is driven by how people act during a mania. Some call it The greater fool theory; somebody invests more than an object's real value assuming there will be a greater fool in the future willing to pay a higher premium. This growth never keeps up in the long run, if you understand math you'll see why. So when some of you are making some money on the current cryptocurrency, even though it looks okay for the moment, I can tell you it's not going to last.

and to be quite honest most currencies match that market. Here is the USD for example

Most people that get into an investment before the bubble make a profit - this is fairly basic stuff.

But most people that start after the "greed" moment (from the graph in @efikkan 's post) don't make a profit.

So if this turns out to be a bubble and profitability stays on current level (or more likely: drops even further), people that started in June will lose money.

Your role in this is pretty simple. You're the one who made the hugely popular mining thread - you've presented mining as a great investment with no risk ("free money"), you've consulted people on setting up their rigs etc. It was most likely the first time many people on TPU really decided to learn something about mining (me included) and some of them invested into it as a result.

After merely 2 months you're simply telling those people that they started to late. Nice going.The 2-year guarantee is only applicable to consumer purchases (much like the 14-day return policy).

So it only protects you if you're a consumer buying a new product from a retailer, when both parties have to be legally registered in EU.

It would be enough for a GPU vendor to offer mining GPUs only for commercial use. The same is true if the cards were sold and shipped directly from Asia.

The 980Ti is an amazing GPU and still packs a nice punch. For the price it's a heck of a steal.

Not everyone needs a 1080Ti nor want to spend that kind of money.

I would say "idiotic" timeframe to me was spending $500 on an rx480/580 or $550+ on a 1070. Maybe I should have phrased that better.

The gpu price has actually fallen back down for most nvidia cards and right this second wouldn't be an awful buy in if you did so frugally.

I still build mining rigs 2-3 times a week for customers.

All of my rigs are paid off but I started back in Feb.(?)I dont really earn that much less now with stock speeds, maybe 10% but much less headache. I need that time to put into a home business that was suffering when I sent most my time into taking care of the mining rigs. Next month I will sent a few days in cleaning the rigs out.

Thank you.

1. There should be mining-focused versions of cards. Example: RX 570D [$150] = 1792 Stream processors, low 1200 MHz core clock, 4GB GDDR5, only 2 display outputs, and a 30-day warranty. This would be an excellent card for mining (Almost equal to a 580 for $100 less and lower power usage), and if mining demand dries up it still makes a good budget gaming card!

2. AMD needs to make MORE CARDS, but I suspect they are taking this seriously with Vega though for the first time. It seems like they took an extra week to make sure Vega is programmed to be the ultimate mining card, and they will hopefully come prepared with extra stock.

Mining cards are lower priced than graphics cards. They have a different return policy (very restrictive to protect the manufacturers from mining fluctuations). They don't have any display outputs which forbids them from being of any value to gamers. The thing is, these cards take months to get to the public so this round, they're wholly unprepared. Next time, they should be able to ramp production of mining-specific cards and hopefully shelter gamers from getting gouged.

They can't just produce more graphics cards now because it slaps them in the face when the mining market collapses.Which means four lost sales for AMD/NVIDIA.

And if it will decrease? You've planned that?

Also, I don't know where you live and how much you pay for electricity, but R9 380 is already not breaking even in a fairly large part of the world.

With cheap electricity (US, Eastern Europe) your 4 cards will make maybe $700 during first year. Is it really worth the work and inconvenience?

It might all look great now: $700 "free money". But time goes by and POV changes. Go through @cdawall 's thread - you'll see how many people gave up because they felt it's pointless. And most stopped mining at higher mining rates that we have today.

Also, by the end of the year ethereum should switch to POS and your cards might not make a profit afterwards. So the fun could stop before you hit those 5 months.

And the release of next gen cards (Vega, Volta) will not help either.

AMD must surely regret using HBM2 for Vega. Even if they could supply enough chips, they would still remain limited by HBM2 supplies. If they used GDDR5(X), they could even have dumped a lower binning just for the miners.

BTW, what is your expected GDDR version of Vega10 named?

www.tweaktown.com/articles/8229/ethereum-mining-1gh-40-gpus-5000-per-month/index.html

To be fair, his mining set up required shit loads of devotion and loads of cash but still, to me it's just another blight on our world of quick cash grabs at the expense of others.

Stop mining and do some folding. You might get some cash back but it wont cure your cancer.