Thursday, April 25th 2019

Intel Reports First-Quarter 2019 Financial Results

Intel Corporation today reported first-quarter 2019 financial results. "Results for the first quarter were slightly higher than our January expectations. We shipped a strong mix of high performance products and continued spending discipline while ramping 10nm and managing a challenging NAND pricing environment. Looking ahead, we're taking a more cautious view of the year, although we expect market conditions to improve in the second half," said Bob Swan, Intel CEO. "Our team is focused on expanding our market opportunity, accelerating our innovation and improving execution while evolving our culture. We aim to capitalize on key technology inflections that set us up to play a larger role in our customers' success, while improving returns for our owners."

In the first quarter, the company generated approximately $5.0 billion in cash from operations, paid dividends of $1.4 billion and used $2.5 billion to repurchase 49 million shares of stock. In the first quarter, Intel achieved 4 percent growth in the PC-centric business while data-centric revenue declined 5 percent.The PC-centric business (CCG) was up 4 percent in the first quarter due to a strong mix of Intel's higher performance products and strength in gaming, large commercial and modem. Intel's first high-volume 10 nm processor, code-named Ice Lake, remains on track to be in volume systems on retail shelves for the 2019 holiday selling season.

Collectively, Intel's data-centric businesses declined 5 percent YoY in the first quarter. In the Data Center Group (DCG), the cloud segment grew 5 percent while the communications service provider segment declined 4 percent and enterprise and government revenue declined 21 percent. First-quarter Internet of Things Group (IOTG) revenue grew 8 percent YoY (19 percent excluding Wind River1), and Mobileye achieved record first-quarter revenue of $209 million, up 38 percent YoY as customer momentum continued. Intel's memory business (NSG) was down 12 percent YoY in a challenging pricing environment. Intel's Programmable Solutions Group (PSG) revenue was down 2 percent YoY in the first quarter.

The first quarter marked the introduction of a broad, new portfolio of data-centric products from Intel featuring the 2nd-Generation Intel Xeon Scalable processor family with integrated Intel Deep Learning Boost (Intel DL Boost) for AI deep learning inferencing acceleration and support for Intel Optane DC persistent memory, the revolutionary technology that brings affordable, high-capacity persistent memory to Intel's data-centric computing portfolio. Intel also introduced more than 50 workload-optimized Intel Xeon processors, a 56-core, 12 memory channel Intel Xeon Platinum 9200 processor, and the new Intel Agilex line of 10 nm-based FPGAs.

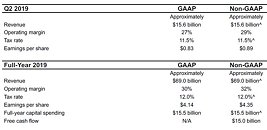

Business Outlook

Intel's guidance for the second-quarter and full-year 2019 includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after April 25, 2019. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements."

In the first quarter, the company generated approximately $5.0 billion in cash from operations, paid dividends of $1.4 billion and used $2.5 billion to repurchase 49 million shares of stock. In the first quarter, Intel achieved 4 percent growth in the PC-centric business while data-centric revenue declined 5 percent.The PC-centric business (CCG) was up 4 percent in the first quarter due to a strong mix of Intel's higher performance products and strength in gaming, large commercial and modem. Intel's first high-volume 10 nm processor, code-named Ice Lake, remains on track to be in volume systems on retail shelves for the 2019 holiday selling season.

Collectively, Intel's data-centric businesses declined 5 percent YoY in the first quarter. In the Data Center Group (DCG), the cloud segment grew 5 percent while the communications service provider segment declined 4 percent and enterprise and government revenue declined 21 percent. First-quarter Internet of Things Group (IOTG) revenue grew 8 percent YoY (19 percent excluding Wind River1), and Mobileye achieved record first-quarter revenue of $209 million, up 38 percent YoY as customer momentum continued. Intel's memory business (NSG) was down 12 percent YoY in a challenging pricing environment. Intel's Programmable Solutions Group (PSG) revenue was down 2 percent YoY in the first quarter.

The first quarter marked the introduction of a broad, new portfolio of data-centric products from Intel featuring the 2nd-Generation Intel Xeon Scalable processor family with integrated Intel Deep Learning Boost (Intel DL Boost) for AI deep learning inferencing acceleration and support for Intel Optane DC persistent memory, the revolutionary technology that brings affordable, high-capacity persistent memory to Intel's data-centric computing portfolio. Intel also introduced more than 50 workload-optimized Intel Xeon processors, a 56-core, 12 memory channel Intel Xeon Platinum 9200 processor, and the new Intel Agilex line of 10 nm-based FPGAs.

Business Outlook

Intel's guidance for the second-quarter and full-year 2019 includes both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after April 25, 2019. Actual results may differ materially from Intel's Business Outlook as a result of, among other things, the factors described under "Forward-Looking Statements."

6 Comments on Intel Reports First-Quarter 2019 Financial Results

The great news is that they might release 10nm products this year, keyword being might ~ Intel Starts Qualification of Ice Lake CPUs, Raises 10nm Volume Expectation for 2019

Operational costs and investments went up. Setting up new fabs?

First contact with a financial statement?

Managing lowering units in 2018 while 2018 is a year of PC market and server market expansion.

A really good job Intel.