Mar 29th, 2025 19:13 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Upgrade from a AMD AM3+ to AM4 or AM5 chipset MB running W10? (46)

- Overclocking ROG Astral 5080 - Power Limited (1)

- Undervolting help for newbie - msi vector i9 13980 hx rtx 4080 (13)

- GPU Crashing System From Hibernation (6)

- RTX 5000 Series Stable Driver? (8)

- Dell Workstation Owners Club (3314)

- Display panel recommendation for low brightness and BFEP (0)

- Intel Arc A770 LE Temperature (4)

- Throttlestop undervolt asus tuf f15 i5-10300H NEED HELP UNCLEWEBB (7)

- What's your latest tech purchase? (23426)

Popular Reviews

- Sapphire Radeon RX 9070 XT Pulse Review

- ASRock Phantom Gaming B850 Riptide Wi-Fi Review - Amazing Price/Performance

- Samsung 9100 Pro 2 TB Review - The Best Gen 5 SSD

- Assassin's Creed Shadows Performance Benchmark Review - 30 GPUs Compared

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- be quiet! Pure Rock Pro 3 Black Review

- Palit GeForce RTX 5070 GamingPro OC Review

- ASRock Radeon RX 9070 XT Taichi OC Review - Excellent Cooling

- Pulsar Feinmann F01 Review

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (142)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (96)

- Retailers Anticipate Increased Radeon RX 9070 Series Prices, After Initial Shipments of "MSRP" Models (90)

- China Develops Domestic EUV Tool, ASML Monopoly in Trouble (88)

News Posts matching #Huawei

Return to Keyword Browsing

Russian Baikal-S Processor With 48 Arm-Based Cores Boots Up, Uses RISC-V Coprocessor for Safe Boot and Management

In recent years, government institutions have been funding the development of home-grown hardware that will power the government infrastructure. This trend was born out of a desire to design chips with no back doors implemented so that no foreign body could monitor the government's processes. Today, Russian company Baikal Electronics managed to boot up the Baikal-S processor with 48 cores based on Arm Instruction Set Architecture (ISA). The processor codenamed BE-S1000 manages to operate 48 cores at a 2.0 GHz base frequency, with a maximum boost of 2.5 GHz clock speed. All of that is achieved at the TDP of 120 Watts, making this design very efficient.

When it comes to some server configurations, the Baikal-S processor run in up to four sockets in a server board. It offers a home-grown RISC-V processor for safe boot and management, so the entire SoC is controlled by a custom design. Baikal Electronics provided some benchmark numbers, which you can see in the slides below. They cover SPEC2006 CPU Integer, Coremark, Whetstone, 7Zip, and HPLinkpack performance. Additionally, the company claims that Baikal-S is in line with Intel Xeon Gold 6148 Skylake design and AMD EPYC 7351 CPU based on Zen1 core. Compared to Huawei's Kunpeng 920, the Baikal-S design provides 0.86x performance.

When it comes to some server configurations, the Baikal-S processor run in up to four sockets in a server board. It offers a home-grown RISC-V processor for safe boot and management, so the entire SoC is controlled by a custom design. Baikal Electronics provided some benchmark numbers, which you can see in the slides below. They cover SPEC2006 CPU Integer, Coremark, Whetstone, 7Zip, and HPLinkpack performance. Additionally, the company claims that Baikal-S is in line with Intel Xeon Gold 6148 Skylake design and AMD EPYC 7351 CPU based on Zen1 core. Compared to Huawei's Kunpeng 920, the Baikal-S design provides 0.86x performance.

Huawei Prepares Laptop Powered by Custom Kirin 5 nm SoC and DDR5 Memory

China's technology reliance on 3rd party companies seems to be getting smaller. One of the leading technology companies in China, Huawei, has designed a laptop powered by a custom 5 nm Kirin SoC with DDR5 memory. Called the Dyna Cloud L420, Huawei has prepared this model for the Chinese market to provide a fully functional laptop that will get the job done, with no risk of the potential security backdoors implemented in the processor. Powered by a brand new Kirin 9006C SoC manufactured on TSMC's 5 nm process, it features eight unknown cores running at 3.1 GHz frequency. We assume that those are custom cores designed by Huawei. This SoC is accompanied by 8 GB of LPDDR5 memory, with 256 GB and 512 GB UFS 3.1 configurations storage options.

When it comes to the rest of the laptop, it rocks a 14-inch 2160x1440 display. I/O options are solid as well, as this machine has an HDMI video output, two USB-A, one USB-C, and Gigabit Ethernet using a mini-RJ45 port. Connectivity is provided by Wi-Fi 6 and Bluetooth 4.2. There is a 56 W/h battery that provides the juice to keep it running when it comes to the battery. And to complete all of that, this laptop officially only supports Huawei's proprietary Kirin OS (KOS) and Unity OS (UOS), with expected support for HarmonyOS in the future. Pricing and availability information is a mistery at the present date.

When it comes to the rest of the laptop, it rocks a 14-inch 2160x1440 display. I/O options are solid as well, as this machine has an HDMI video output, two USB-A, one USB-C, and Gigabit Ethernet using a mini-RJ45 port. Connectivity is provided by Wi-Fi 6 and Bluetooth 4.2. There is a 56 W/h battery that provides the juice to keep it running when it comes to the battery. And to complete all of that, this laptop officially only supports Huawei's proprietary Kirin OS (KOS) and Unity OS (UOS), with expected support for HarmonyOS in the future. Pricing and availability information is a mistery at the present date.

Global OSAT Revenue for 3Q21 Reaches US$8.89 Billion Thanks to Peak Season Demand, Says TrendForce

As the global vaccination rate rose, and border restrictions in Europe and North America eased, social activities also began to enter a period of recovery, with the consumer electronics market seemingly ready for the arrival of the traditional peak season in 2H21, according to TrendForce's latest investigations. At the same time, however, the global supply chain was affected by delays in maritime transport, skyrocketing shipping costs, and component shortages, in addition to already-prohibitive price hikes for certain components in 1H21. Given the parallel rise in both material and manufacturing costs, the market for end products has not undergone the expected cyclical upturn in 2H21. Even so, the overall demand for and shipment of smartphones, notebook computers, and monitors experienced QoQ increases in 3Q21, thereby driving up businesses for major OSAT (outsourced semiconductor assembly and test) companies. For 3Q21, the revenues of the top 10 OSAT companies reached US$8.89 billion, a 31.6% YoY increase.

Worldwide Enterprise WLAN Market Continued Strong Growth in Second Quarter 2021, According to IDC

Growth rates remained strong in the enterprise segment of the wireless local area networking (WLAN) market in the second quarter of 2021 (2Q21) as the market increased 22.4% on a year-over-year basis to $1.7 billion, according to the International Data Corporation (IDC) Worldwide Quarterly Wireless LAN Tracker. In the consumer segment of the WLAN market, revenues declined 5.7% in the quarter to $2.3 billion, giving the combined enterprise and consumer WLAN markets year-over-year growth of 4.6% in 2Q21.

The growth in the enterprise-class segment of the market builds on a strong first quarter of 2021 when revenues increased 24.6% year over year. For the first half of 2021, the market increased 23.5% compared to first two quarters of 2020. Compared to the second quarter of 2019, 2Q21 revenues increased 10.8%, indicating that demand in the enterprise WLAN is strong.

The growth in the enterprise-class segment of the market builds on a strong first quarter of 2021 when revenues increased 24.6% year over year. For the first half of 2021, the market increased 23.5% compared to first two quarters of 2020. Compared to the second quarter of 2019, 2Q21 revenues increased 10.8%, indicating that demand in the enterprise WLAN is strong.

Revenue of Top 10 OSAT Companies for 2Q21 Reaches US$7.88 Billion Due to Strong Demand and Increased Package/Test Prices, Says TrendForce

Despite the intensifying COVID-19 pandemic that swept Taiwan in 2Q21, the domestic OSAT (outsourced semiconductor assembly and test) industry remained largely intact, according to TrendForce's latest investigations. Global sales of large-sized TVs were brisk thanks to major sporting events such as the Tokyo Olympics and UEFA Euro 2020. Likewise, the proliferation of WFH and distance learning applications propelled the demand for IT products, while the automotive semiconductor and data center markets also showed upward trajectories. Taking into account the above factors, OSAT companies raised their quotes in response, resulting in a 26.4% YoY increase in the top 10 OSAT companies' revenue to US$7.88 billion for 2Q21.

TrendForce indicates that, in light of the ongoing global chip shortage and the growing production capacities of foundries/IDMs in the upstream semiconductor supply chain, OSAT companies gradually increased their CAPEX and expanded their fabs and equipment in order to meet the persistently growing client demand. However, the OSAT industry still faces an uncertain future in 2H21 due to the Delta variant's global surge and the health crisis taking place in Southeast Asia, home to a significant number of OSAT facilities.

TrendForce indicates that, in light of the ongoing global chip shortage and the growing production capacities of foundries/IDMs in the upstream semiconductor supply chain, OSAT companies gradually increased their CAPEX and expanded their fabs and equipment in order to meet the persistently growing client demand. However, the OSAT industry still faces an uncertain future in 2H21 due to the Delta variant's global surge and the health crisis taking place in Southeast Asia, home to a significant number of OSAT facilities.

IDC Forecasts Companies to Spend Almost $342 Billion on AI Solutions in 2021

Worldwide revenues for the artificial intelligence (AI) market, including software, hardware, and services, is estimated to grow 15.2% year over year in 2021 to $341.8 billion, according to the latest release of the International Data Corporation (IDC) Worldwide Semiannual Artificial Intelligence Tracker. The market is forecast to accelerate further in 2022 with 18.8% growth and remain on track to break the $500 billion mark by 2024. Among the three technology categories, AI Software occupied 88% of the overall AI market. However, in terms of growth, AI Hardware is estimated to grow the fastest in the next several years. From 2023 onwards, AI Services is forecast to become the fastest growing category.

Within the AI Software category, AI Applications has the lion's share at nearly 50% of revenues. In terms of growth, AI Platforms is the strongest with a five-year compound annual growth rate (CAGR) of 33.2%. The slowest will be AI System Infrastructure Software with a five-year CAGR of 14.4% while accounting for roughly 35% of all AI Software revenues. Within the AI Applications market, AI ERM is expected to grow slightly stronger than AI CRM over the next five years. Meanwhile, AI Lifecycle Software is forecast to grow the fastest among the markets within AI Platforms.

Within the AI Software category, AI Applications has the lion's share at nearly 50% of revenues. In terms of growth, AI Platforms is the strongest with a five-year compound annual growth rate (CAGR) of 33.2%. The slowest will be AI System Infrastructure Software with a five-year CAGR of 14.4% while accounting for roughly 35% of all AI Software revenues. Within the AI Applications market, AI ERM is expected to grow slightly stronger than AI CRM over the next five years. Meanwhile, AI Lifecycle Software is forecast to grow the fastest among the markets within AI Platforms.

Linux Foundation to Form New Open 3D Foundation

The Linux Foundation, the nonprofit organization enabling mass innovation through open source, today announced an intent to form the Open 3D Foundation to accelerate developer collaboration on 3D game and simulation technology. The Open 3D Foundation will support open source projects that advance capabilities related to 3D graphics, rendering, authoring, and development. As the first project governed by the new foundation, Amazon Web Services, Inc. (AWS) is contributing an updated version of the Amazon Lumberyard game engine as the Open 3D Engine (O3DE), under the permissive Apache 2.0 license. The Open 3D Engine enables developers and content creators to build 3D experiences unencumbered by commercial terms and will provide the support and infrastructure of an open source community through forums, code repositories, and developer events. A developer preview of O3DE is available on GitHub today. For more information and/or to contribute, please visit: https://o3de.org

3D engines are used to create a range of virtual experiences, including games and simulations, by providing capabilities such as 3D rendering, content authoring tools, animation, physics systems, and asset processing. Many developers are seeking ways to build their intellectual property on top of an open source engine where the roadmap is highly visible, openly governed, and collaborative to the community as a whole. More developers look to be able to create or augment their current technological foundations with highly collaborative solutions that can be used in any development environment. O3DE introduces a new ecosystem for developers and content creators to innovate, build, share, and distribute immersive 3D worlds that will inspire their users with rich experiences that bring the imaginations of their creators to life.

3D engines are used to create a range of virtual experiences, including games and simulations, by providing capabilities such as 3D rendering, content authoring tools, animation, physics systems, and asset processing. Many developers are seeking ways to build their intellectual property on top of an open source engine where the roadmap is highly visible, openly governed, and collaborative to the community as a whole. More developers look to be able to create or augment their current technological foundations with highly collaborative solutions that can be used in any development environment. O3DE introduces a new ecosystem for developers and content creators to innovate, build, share, and distribute immersive 3D worlds that will inspire their users with rich experiences that bring the imaginations of their creators to life.

HiSilicon Develops RISC-V Processor to Move Away from Arm Restrictions

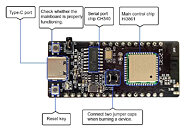

Huawei's HiSilicon subsidiary, which specialized in the design and development of semiconductor devices like processors, has made a big announcement today. A while back, the US government has blacklisted Huawei from using any US-made technology. This has rendered HiSilicon's efforts of building processors based on Arm architecture (ISA) practically useless, as the US sanctions applied to that as well. So, the company had to turn to alternative technologies. Today, HiSilicon has announced the new HiSilicon Hi3861 development board, based on RISC-V architecture. This represents an important step to Huawei's silicon independence, as RISC-V is a free and open-source ISA designed for all kinds of workloads.

While the HiSilicon Hi3861 development board features a low-power Hi3861 chip, it is the company's first attempt at building a RISC-V design. It features a "high-performance 32-bit microprocessor with a maximum operating frequency of 160 MHz". While this may sound very pale in comparison to the traditional HiSilicon products, this chip is used for IoT applications, which don't require much processing power. For tasks that need better processing, HiSilicon will surely develop more powerful designs. This just represents an important starting point, where Huawei's HiSilicon moves away from Arm ISA, and steps into another ISA design and development. This time, with RISC-V, the US government has no control over the ISA, as it is free to use by anyone who pleases, with added benefits of no licensing costs. It is interesting to see where this will lead HiSilicon and what products the company plans to release on the new ISA.

While the HiSilicon Hi3861 development board features a low-power Hi3861 chip, it is the company's first attempt at building a RISC-V design. It features a "high-performance 32-bit microprocessor with a maximum operating frequency of 160 MHz". While this may sound very pale in comparison to the traditional HiSilicon products, this chip is used for IoT applications, which don't require much processing power. For tasks that need better processing, HiSilicon will surely develop more powerful designs. This just represents an important starting point, where Huawei's HiSilicon moves away from Arm ISA, and steps into another ISA design and development. This time, with RISC-V, the US government has no control over the ISA, as it is free to use by anyone who pleases, with added benefits of no licensing costs. It is interesting to see where this will lead HiSilicon and what products the company plans to release on the new ISA.

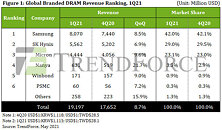

DRAM Revenue for 1Q21 Undergoes 8.7% Increase QoQ Thanks to Increased Shipment as Well as Higher Prices, Says TrendForce

Demand for DRAM exceeded expectations in 1Q21 as the proliferation of WFH and distance education resulted in high demand for notebook computers against market headwinds, according to TrendForce's latest investigations. Also contributing to the increased DRAM demand was Chinese smartphone brands' ramp-up of component procurement while these companies, including OPPO, Vivo, and Xiaomi, attempted to seize additional market shares after Huawei's inclusion on the Entity List. Finally, DRAM demand from server manufacturers also saw a gradual recovery. Taken together, these factors led to higher-than-expected shipments from various DRAM suppliers in 1Q21 despite the frequent shortage of such key components as IC and passive components. On the other hand, DRAM prices also entered an upward trajectory in 1Q21 in accordance with TrendForce's previous forecasts. In light of the increases in both shipments and quotes, all DRAM suppliers posted revenue growths in 1Q21, and overall DRAM revenue for the quarter reached US$19.2 billion, an 8.7% growth QoQ.

Demand for PC, mobile, graphics, and special DRAM remains healthy in 2Q21. Furthermore, after two to three quarters of inventory reduction during which their DRAM demand was relatively sluggish, some server manufacturers have now kicked off a new round of procurement as they expect a persistent increase in DRAM prices. TrendForce therefore forecasts a significant QoQ increase in DRAM ASP in 2Q21. In conjunction with increased bit shipment, this price hike will likely drive total DRAM revenue for 2Q21 to increase by more than 20% QoQ.

Demand for PC, mobile, graphics, and special DRAM remains healthy in 2Q21. Furthermore, after two to three quarters of inventory reduction during which their DRAM demand was relatively sluggish, some server manufacturers have now kicked off a new round of procurement as they expect a persistent increase in DRAM prices. TrendForce therefore forecasts a significant QoQ increase in DRAM ASP in 2Q21. In conjunction with increased bit shipment, this price hike will likely drive total DRAM revenue for 2Q21 to increase by more than 20% QoQ.

Global Server Shipment for 2021 Projected to Grow by More than 5% YoY, Says TrendForce

Enterprise demand for cloud services has been rising steady in the past two years owing to the rapidly changing global markets and uncertainties brought about by the COVID-19 pandemic. TrendForce's investigations find that most enterprises have been prioritizing cloud service adoption across applications ranging from AI to other emerging technologies as cloud services have relatively flexible costs. Case in point, demand from clients in the hyperscale data center segment constituted more than 40% of total demand for servers in 4Q20, while this figure may potentially approach 45% for 2021. For 2021, TrendForce expects global server shipment to increase by more than 5% YoY and ODM Direct server shipment to increase by more than 15% YoY.

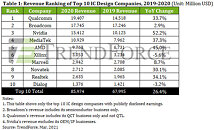

Revenue of Top 10 IC Design (Fabless) Companies for 2020 Undergoes 26.4% Increase YoY, Says TrendForce

The emergence of the COVID-19 pandemic in 1H20 seemed at first poised to devastate the IC design industry. However, as WFH and distance education became the norm, TrendForce finds that the demand for notebook computers and networking products also spiked in response, in turn driving manufacturers to massively ramp up their procurement activities for components. Fabless IC design companies that supply such components therefore benefitted greatly from manufacturers' procurement demand, and the IC design industry underwent tremendous growth in 2020. In particular, the top three IC design companies (Qualcomm, Broadcom, and Nvidia) all posted YoY increases in their revenues, with Nvidia registering the most impressive growth, at a staggering 52.2% increase YoY, the highest among the top 10 companies.

DRAM Revenue for 4Q20 Undergoes Modest 1.1% Increase QoQ in Light of Continued Rising Shipment and Falling Prices, Says TrendForce

Global DRAM revenue reached US$17.65 billion, a 1.1% increase YoY, in 4Q20, according to TrendForce's latest investigations. For the most part, this growth took place because Chinese smartphone brands, including Oppo, Vivo, and Xiaomi, expanded their procurement activities for components in order to seize the market shares made available after Huawei was added to the Entity List by the U.S. Department of Commerce. These procurement activities in turn provided upward momentum for DRAM suppliers' bit shipment. However, clients in the server segment were still in the middle of inventory adjustments during this period, thereby placing downward pressure on DRAM prices. As a result, revenues of most DRAM suppliers, except for Micron, remained somewhat unchanged in 4Q20 compared to 3Q20. Micron underwent a noticeable QoQ decline in 4Q20 (which Micron counts as its fiscal 1Q21), since Micron had fewer work weeks during this period compared to the previous quarter.

Gartner Says Worldwide Smartphone Sales Declined 5% in Fourth Quarter of 2020

Global sales of smartphones to end users declined 5.4% in the fourth quarter of 2020, according to Gartner, Inc. Smartphone sales declined 12.5% in full year 2020.

"The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020," said Anshul Gupta, senior research director at Gartner. "Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter."

"The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020," said Anshul Gupta, senior research director at Gartner. "Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter."

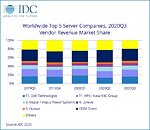

Worldwide Server Market Revenue Grew 2.2% Year Over Year in the Third Quarter of 2020, According to IDC

According to the International Data Corporation (IDC) Worldwide Quarterly Server Tracker, vendor revenue in the worldwide server market grew 2.2% year over year to $22.6 billion during the third quarter of 2020 (3Q20). Worldwide server shipments declined 0.2% year over year to nearly 3.1 million units in 3Q20. Volume server revenue was up 5.8% to $19.0 billion, while midrange server revenue declined 13.9% to $2.6 billion, and high-end servers declined by 12.6% to $937 million.

"Global demand for enterprise servers was a bit muted during the third quarter of 2020 although we did see areas of strong demand," said Paul Maguranis, senior research analyst, Infrastructure Platforms and Technologies at IDC. "From a regional perspective, server revenue within China grew 14.2% year over year. And worldwide revenues for servers running AMD CPUs were up 112.4% year over year while ARM-based servers grew revenues 430.5% year over year, albeit on a very small base of revenue."

"Global demand for enterprise servers was a bit muted during the third quarter of 2020 although we did see areas of strong demand," said Paul Maguranis, senior research analyst, Infrastructure Platforms and Technologies at IDC. "From a regional perspective, server revenue within China grew 14.2% year over year. And worldwide revenues for servers running AMD CPUs were up 112.4% year over year while ARM-based servers grew revenues 430.5% year over year, albeit on a very small base of revenue."

DRAM ASP to Recover from Decline in 1Q21, with Potential for Slight Growth, Says TrendForce

The DRAM market exhibits a healthier and more balanced supply/demand relationship compared with the NAND Flash market because of its oligopolistic structure, according to TrendForce's latest investigations. The percentage distribution of DRAM supply bits by application currently shows that PC DRAM accounts for 13%, server DRAM 34%, mobile DRAM 40%, graphics DRAM 5%, and consumer DRAM (or specialty DRAM) 8%. Looking ahead to 1Q21, the DRAM market by then will have gone through an inventory adjustment period of slightly more than two quarters. Memory buyers will also be more willing to stock up because they want to reduce the risk of future price hikes. Therefore, DRAM prices on the whole will be constrained from falling further. The overall ASP of DRAM products is now forecasted to stay generally flat or slightly up for 1Q21.

NAND Flash Revenue for 3Q20 up by Only 0.3% QoQ Owing to Weak Server Sales, Says TrendForce

Total NAND Flash revenue reached US$14.5 billion in 3Q20, a 0.3% increase QoQ, while total NAND Flash bit shipment rose by 9% QoQ, but the ASP fell by 9% QoQ, according to TrendForce's latest investigations. The market situation in 3Q20 can be attributed to the rising demand from the consumer electronics end as well as the recovering smartphone demand before the year-end peak sales season. Notably, in the PC market, the rise of distance education contributed to the growing number and scale of Chromebook tenders, but the increase in the demand for Chromebook devices has not led to a significant increase in NAND Flash consumption because storage capacity is rather limited for this kind of notebook computer. Moreover, clients in the server and data center segments had aggressively stocked up on components and server barebones during 2Q20 due to worries about the impact of the pandemic on the supply chain. Hence, their inventories reached a fairly high level by 3Q20. Clients are now under pressure to control and reduce their inventories during this second half of the year. With them scaling back procurement, the overall NAND Flash demand has also weakened, leading to a downward turn in the contract prices of most NAND Flash products.

Huawei to Enter Silicon Manufacturing Business without US Technologies

Semiconductor manufacturing has been the latest victim of the recent trade war between China and the United States. With the US imposing sanctions on Chinese manufacturers, they have not been able to use any US technology without the approval of the US government. That has caused many companies to lose customers and switch their preferred foundry. The US government has also decided to sanction a Chinese company Huawei from accessing any US-technology-based manufacturing facilities, thus has prevented the Chinese company from manufacturing its chips in the facilities of TSMC. Left without almost any way to keep up with the latest semiconductor technology, Huawei is reportedly working on its own manufacturing facilities.

According to the Financial Times, Huawei is about to enter domestic silicon production with its partner company Shanghai IC R&D. And a big note here is that the manufacturing facility will not use any US technology. The production is allegedly going to start as soon as the end of this year, and the first process that will come out the door will be a rather outdated 45 nm node. The company is expecting to move on to a more advanced 28 nm node by the end of next year. While the capacities are unknown, we can assume that it will be enough for the company's purposes. With this move, Huawei will be 100% independent from any US influence and will own the complete vector of software and hardware, that is a custom made design by the company.Huawei R&D Center

According to the Financial Times, Huawei is about to enter domestic silicon production with its partner company Shanghai IC R&D. And a big note here is that the manufacturing facility will not use any US technology. The production is allegedly going to start as soon as the end of this year, and the first process that will come out the door will be a rather outdated 45 nm node. The company is expecting to move on to a more advanced 28 nm node by the end of next year. While the capacities are unknown, we can assume that it will be enough for the company's purposes. With this move, Huawei will be 100% independent from any US influence and will own the complete vector of software and hardware, that is a custom made design by the company.Huawei R&D Center

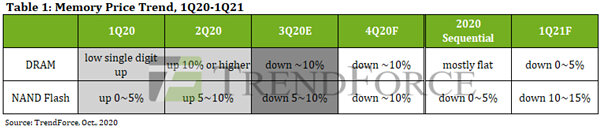

SSD Prices Expected To Fall 10-15% in Q4 2020

The memory market is expected to remain in a state of oversupply during Q4 2020 for both DRAM and NAND flash according to a new report from TrendForce. This oversupply will mean ~10% lower prices for memory in Q4 2020 with further price drops in 2021, this will result in falling SSD prices of 10-15%. These price drops in the consumer market will likely result in the lowest SSD pricing seen to date. These reductions were mainly driven by Huawei losing access to foreign DRAM and NAND memory which wasn't fully taken up by other smartphone manufacturers leading to an access of supply. These lower SSD prices will help accelerate the decline of HDDs in consumer devices as price parity gets closer.

China Could Reject NVIDIA-Arm Deal, Predicts Former Lenovo Chief Engineer

In big corporate mergers and acquisitions involving multi-national corporations, money is the easy part, with the hard part being competition regulators of major markets giving their assent. The NVIDIA-Arm deal could get entangled in the US-China tech trade-war, with Beijing likely to use its approval of the deal as a bargaining chip against the US. Former Lenovo chief engineer Ni Guangnan predicts that the Chinese government's position would be to try and fight the deal on anti-trust grounds, as it could create a monopoly of chip-design tools. China's main concern, however, would be Arm IP falling into the hands of a US corporation, the California-based NVIDIA, which would put the IP under US export-control regulations.

Both Arm and NVIDIA announced an agreement for the latter to acquire Arm from SoftBank in a deal valued at USD $40 billion. NVIDIA CEO has been quoted as calling it the "deal of the century," as it would put NVIDIA in control of the biggest CPU machine architecture standard after Intel's x86, letting it scale the IP from low-power edge SoCs, to large data-center processors. Chinese regulators could cite recent examples of US export controls harming the Chinese tech industry, such as technology bans over Huawei and SMIC, in its action against the NVIDIA-Arm deal. Arm's 200-odd Chinese licensees have shipped over 19 billion chips based on the architecture as of mid-September 2020.

Both Arm and NVIDIA announced an agreement for the latter to acquire Arm from SoftBank in a deal valued at USD $40 billion. NVIDIA CEO has been quoted as calling it the "deal of the century," as it would put NVIDIA in control of the biggest CPU machine architecture standard after Intel's x86, letting it scale the IP from low-power edge SoCs, to large data-center processors. Chinese regulators could cite recent examples of US export controls harming the Chinese tech industry, such as technology bans over Huawei and SMIC, in its action against the NVIDIA-Arm deal. Arm's 200-odd Chinese licensees have shipped over 19 billion chips based on the architecture as of mid-September 2020.

Samsung and SK Hynix to Impose Sanctions Against Huawei

Ever since the Trump administration imposed sanctions against Huawei to stop it from purchasing parts from third-party vendors to bypass the ban announced back in May, some vendors continued to supply the company. So it seems like some Korean manufacturers will be joining the doings of the US government, and apply restrictions to Huawei. According to the reports of South Korean media outlets, Samsung Electronics and SK Hynix will be joining the efforts of the US government and the Trump administration to impose sanctions against Chinese technology giant - Huawei.

It is reported that on September 15th, both Samsung and SK Hynix will stop any shipments to Huawei, where Samsung already stopped efforts for creating any new shipments. SK Hynix is said to continue shipping DRAM and NAND Flash products until September 14th, a day before the new sanctions are applied. Until the 14th, Huawei will receive some additional chips from SK Hynix. And it is exactly SK Hynix who is said to be a big loser here. It is estimated that 41.2% of SK Hynix's H1 2020 revenue came from China, most of which was memory purchased for Huawei phones and tablets. If the company loses Huawei as a customer, it would mean that the revenue numbers will be notably lower.

It is reported that on September 15th, both Samsung and SK Hynix will stop any shipments to Huawei, where Samsung already stopped efforts for creating any new shipments. SK Hynix is said to continue shipping DRAM and NAND Flash products until September 14th, a day before the new sanctions are applied. Until the 14th, Huawei will receive some additional chips from SK Hynix. And it is exactly SK Hynix who is said to be a big loser here. It is estimated that 41.2% of SK Hynix's H1 2020 revenue came from China, most of which was memory purchased for Huawei phones and tablets. If the company loses Huawei as a customer, it would mean that the revenue numbers will be notably lower.

Qualcomm Could Deliver Chips to Huawei

In the ave of the news that Trump administration has forbidden TSMC to have Huawei as its customer, Huawei seems to be exploring new options for sourcing the best performing mobile processors. As the company has turned to the Chinese SMIC semiconductor factory, it still needs a backup plan in the case of Chinese semiconductor manufacturing flops. So to combat US sanctions, Huawei will use already made chips form the US company - Qualcomm. By sourcing the processors from Qualcomm, Huawei is losing some benefits of customs design like better system integration, however, it will gain quite powerful mobile processors. As Qualcomm is known for providing the fastest processors for Android smartphones, Huawei has ensured that it remains competitive. Qualcomm is reportedly now negotiating with the US government about delivering the chips to Huawei, and if it is allowed, Qualcomm will gain a big customer.

Huawei 24-Core 7 nm Kunpeng CPU Reportedly Beats Intel Core i9-9900K

Huawei is preparing itself against further United States government technology bans with the introduction of its ARM-based 7 nm Kunpeng 920 CPUs in desktop systems for the Chinese government and enterprise markets. The specific chip used in this upcoming computer is the Kunpeng 920 3211K CPU which features 24 cores clocked at 2.6 GHz paired with 8 GB DDR4 memory, 512 GB Samsung SSD, and an AMD Radeon RX 520 GPU. This specific configuration reportedly beats Intel's Core i9-9900K 8-core processor in multi-core performance, while single-core performance is not reported as it likely lags far behind the high clock speeds of the Core i9-9900K. The desktop runs a custom Linux derived UOS operating system and cannot run Windows 10.

TSMC Allocation the Next Battleground for Intel, AMD, and Possibly NVIDIA

With its own 7 nm-class silicon fabrication node nowhere in sight for its processors, at least not until 2022-23, Intel is seeking out third-party semiconductor foundries to support its ambitious discrete GPU and scalar compute processor lineup under the Xe brand. A Taiwanese newspaper article interpreted by Chiakokhua provides a fascinating insight to the the new precious resource in the high-technology industry - allocation.

TSMC is one of these foundries, and will give Intel access to a refined 7 nm-class node, either the N7P or N7+, for some of its Xe scalar compute processors. The company could also seek out nodelets such as the N6. Trouble is, Intel will be locking horns with the likes of AMD for precious foundry allocation. NVIDIA too has secured a certain allocation of TSMC 7 nm for some of its upcoming "Ampere" GPUs. Sources tell China Times that TSMC will commence mass-production of Intel silicon as early as 2021, on either N7P, N7+, or N6. Business from Intel is timely for TSMC as it is losing orders from HiSilicon (Huawei) in wake of the prevailing geopolitical climate.

TSMC is one of these foundries, and will give Intel access to a refined 7 nm-class node, either the N7P or N7+, for some of its Xe scalar compute processors. The company could also seek out nodelets such as the N6. Trouble is, Intel will be locking horns with the likes of AMD for precious foundry allocation. NVIDIA too has secured a certain allocation of TSMC 7 nm for some of its upcoming "Ampere" GPUs. Sources tell China Times that TSMC will commence mass-production of Intel silicon as early as 2021, on either N7P, N7+, or N6. Business from Intel is timely for TSMC as it is losing orders from HiSilicon (Huawei) in wake of the prevailing geopolitical climate.

TSMC to Stop Orders from Huawei in September

TSMC, one of the largest semiconductor manufacturing foundries, has officially confirmed that it will stop all orders from Chinese company Huawei Technologies. The Taiwanese silicon manufacturer has decided to comply with US regulations and will officially stop processing orders for Huawei on September 14th of this year. Precisely, the company was receiving orders from HiSilicon, a subsidiary of Huawei Technologies that focuses on creating custom silicon. Under the new regulation by the US, all non-US companies must apply for a license to ship any American-made technology to Huawei. Being that many American companies like KLA Corporation, Lam Research, and Applied Materials ship their tools to many manufacturing facilities, it would be quite difficult for Huawei to manufacture its silicon anywhere. That is why Huawei has already placed orders over at Chinese SMIC foundry.

Huawei Desktop PC with Kunpeng 920 Processor Teased and Tested

Huawei has been readying the entire new breed of desktop PCs with a custom motherboard, custom processor, and even a custom operating system. Being that Huawei plans to supply Chinese government institutions with these PCs, it is logical to break away from US-made technology due to security reasons. And now, thanks to the YouTube channel called "二斤自制" we have the first look at the new PC system. Powered by Huawei D920S10 desktop motherboard equipped with Kunpeng 920 7 nm Arm v8 processor with 8 cores, the PC was running the 64-bit UOS operating system, which is a Chinese modification of Linux. In the test, the PC was assembled by a third-party provider and it featured 16 GB of 2666 MHz DDR4 memory and 256 GB SSD.

The YouTube channel put it to test and in the Blender BMW render test, it has finished in 11 minutes and 47 seconds, which is quite slow. The system reportedly managed to stream 4K content well but has struggled with local playback thanks to poor encoding. Being that it runs a custom OS with a custom processor, app selection is quite narrow. The app store for the PC is accessible only if you pay an extra 800 Yuan (~$115), while the mentioned system will set you back 7,500 Yuan (~$1,060). At the heart of this system is eight-core, eight threaded Kunpeng 920 2249K processor. It features a clock speed of 2.6 GHz, has 128K of L1 cache (64K instruction cache and 64K data cache), 512K of L2, and 32 MB of L3 cache.

The YouTube channel put it to test and in the Blender BMW render test, it has finished in 11 minutes and 47 seconds, which is quite slow. The system reportedly managed to stream 4K content well but has struggled with local playback thanks to poor encoding. Being that it runs a custom OS with a custom processor, app selection is quite narrow. The app store for the PC is accessible only if you pay an extra 800 Yuan (~$115), while the mentioned system will set you back 7,500 Yuan (~$1,060). At the heart of this system is eight-core, eight threaded Kunpeng 920 2249K processor. It features a clock speed of 2.6 GHz, has 128K of L1 cache (64K instruction cache and 64K data cache), 512K of L2, and 32 MB of L3 cache.

Mar 29th, 2025 19:13 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Upgrade from a AMD AM3+ to AM4 or AM5 chipset MB running W10? (46)

- Overclocking ROG Astral 5080 - Power Limited (1)

- Undervolting help for newbie - msi vector i9 13980 hx rtx 4080 (13)

- GPU Crashing System From Hibernation (6)

- RTX 5000 Series Stable Driver? (8)

- Dell Workstation Owners Club (3314)

- Display panel recommendation for low brightness and BFEP (0)

- Intel Arc A770 LE Temperature (4)

- Throttlestop undervolt asus tuf f15 i5-10300H NEED HELP UNCLEWEBB (7)

- What's your latest tech purchase? (23426)

Popular Reviews

- Sapphire Radeon RX 9070 XT Pulse Review

- ASRock Phantom Gaming B850 Riptide Wi-Fi Review - Amazing Price/Performance

- Samsung 9100 Pro 2 TB Review - The Best Gen 5 SSD

- Assassin's Creed Shadows Performance Benchmark Review - 30 GPUs Compared

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- be quiet! Pure Rock Pro 3 Black Review

- Palit GeForce RTX 5070 GamingPro OC Review

- ASRock Radeon RX 9070 XT Taichi OC Review - Excellent Cooling

- Pulsar Feinmann F01 Review

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (142)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (96)

- Retailers Anticipate Increased Radeon RX 9070 Series Prices, After Initial Shipments of "MSRP" Models (90)

- China Develops Domestic EUV Tool, ASML Monopoly in Trouble (88)