Thursday, November 8th 2012

NVIDIA Reports Financial Results for Third Quarter Fiscal Year 2013

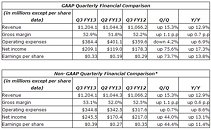

NVIDIA (NASDAQ: NVDA) today reported record revenue of $1.20 billion for the third quarter of fiscal 2013 ended Oct. 28, 2012, up 15.3 percent from the previous quarter and up 12.9 percent from a year earlier.

The company also announced that it is initiating the payment of a quarterly cash dividend, and extending its existing $2.7 billion share-repurchase program, initiated in August 2004, through December 2014.

"Investments in our new growth strategies paid off this quarter in record revenues and margins," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "Kepler GPUs are winning across the special-purpose PC markets we serve, from gaming to design to supercomputing. And Tegra is powering some of the most innovative tablets, phones and cars in the market."

He continued: "We are pleased to start paying our shareholders a quarterly cash dividend. We have confidence in our businesses and our continued ability to grow. Given our strong financial position and ongoing ability to generate cash, we are well positioned to continue investing in our future."Outlook

Our outlook for the fourth quarter of fiscal 2013 is as follows:

Diluted shares for the fourth quarter are expected to be approximately 629 million.

Dividend and Share-Repurchase Program

The quarterly dividend of 7.5 cents per share, 30 cents on an annual basis, is equivalent to a yield of about 2.4 percent, based on the Nov. 7 closing price of $12.61. It will be payable on Dec. 14, 2012 to all shareholders of record on Nov. 23, 2012.

Since NVIDIA initiated its repurchase program in August 2004, NVIDIA has spent $1.46 billion to repurchase 90.9 million shares of its common stock. NVIDIA is authorized, subject to certain specifications, to spend up to an additional $1.24 billion repurchasing shares of its common stock.

Any future repurchases would be made in the open market, in privately negotiated transactions or in structured share-repurchase programs, and may be made from time to time or in one or more larger repurchases. The program will be conducted in compliance with the Securities and Exchange Commission's Rule 10b-18 and applicable legal requirements and shall be subject to market conditions and other factors. The repurchases would be funded from available working capital.

Cash, cash equivalents and marketable securities at the end of the third quarter of fiscal 2013 were $3.43 billion.

Third Quarter Fiscal 2013 and Recent Highlights:

Commentary on the quarter by Karen Burns, NVIDIA interim chief financial officer, is available at www.nvidia.com/ir.

The company also announced that it is initiating the payment of a quarterly cash dividend, and extending its existing $2.7 billion share-repurchase program, initiated in August 2004, through December 2014.

"Investments in our new growth strategies paid off this quarter in record revenues and margins," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "Kepler GPUs are winning across the special-purpose PC markets we serve, from gaming to design to supercomputing. And Tegra is powering some of the most innovative tablets, phones and cars in the market."

He continued: "We are pleased to start paying our shareholders a quarterly cash dividend. We have confidence in our businesses and our continued ability to grow. Given our strong financial position and ongoing ability to generate cash, we are well positioned to continue investing in our future."Outlook

Our outlook for the fourth quarter of fiscal 2013 is as follows:

- Revenue is expected to be between $1.025 billion and $1.175 billion.

- GAAP and non-GAAP gross margins are expected to be flat relative to the prior quarter, 52.9 percent and 53.1 percent, respectively.

- GAAP operating expenses are expected to be approximately $400 million; non-GAAP operating expenses are expected to be approximately $359 million.

- GAAP and non-GAAP tax rates are expected to be approximately 20 percent and 19 percent, respectively, plus or minus one percentage point. This estimate excludes any discrete tax events that may occur during the quarter, which, if realized, may increase or decrease our actual fourth quarter GAAP and non-GAAP tax rates. If the U.S. research tax credit is reinstated into tax law, we estimate our annual effective tax rate for the fiscal year 2013 to be approximately 16 percent.

Diluted shares for the fourth quarter are expected to be approximately 629 million.

Dividend and Share-Repurchase Program

The quarterly dividend of 7.5 cents per share, 30 cents on an annual basis, is equivalent to a yield of about 2.4 percent, based on the Nov. 7 closing price of $12.61. It will be payable on Dec. 14, 2012 to all shareholders of record on Nov. 23, 2012.

Since NVIDIA initiated its repurchase program in August 2004, NVIDIA has spent $1.46 billion to repurchase 90.9 million shares of its common stock. NVIDIA is authorized, subject to certain specifications, to spend up to an additional $1.24 billion repurchasing shares of its common stock.

Any future repurchases would be made in the open market, in privately negotiated transactions or in structured share-repurchase programs, and may be made from time to time or in one or more larger repurchases. The program will be conducted in compliance with the Securities and Exchange Commission's Rule 10b-18 and applicable legal requirements and shall be subject to market conditions and other factors. The repurchases would be funded from available working capital.

Cash, cash equivalents and marketable securities at the end of the third quarter of fiscal 2013 were $3.43 billion.

Third Quarter Fiscal 2013 and Recent Highlights:

- Microsoft launched its NVIDIA Tegra 3-based Surface RT to critical acclaim.

- NVIDIA's new energy-efficient Kepler GPU architecture continued to make excellent headway:

o Kepler-based gaming was extended to new, lower price points with the launch of the GeForce 660 Ti, GeForce GTX 660, GeForce GTX 650 Ti and GeForce GTX 650.

o Kepler made further inroads in supercomputing, as Oak Ridge National Laboratory announced that it had completed Titan, the world's fastest open-science supercomputer. Titan gets 90 percent of its processing power from 18,688 NVIDIA Tesla GPUs.

o Kepler moved further into Apple's lineup, with the NVIDIA Quadro K5000 for Mac Pro users.

o NVIDIA launched the VGX K2 GPU, also based on the Kepler GPU, for cloud-based workstation graphics.

Commentary on the quarter by Karen Burns, NVIDIA interim chief financial officer, is available at www.nvidia.com/ir.

28 Comments on NVIDIA Reports Financial Results for Third Quarter Fiscal Year 2013

The top 2 ownership holdings are:

Fidelity Investments: "Fidelity is a privately held company founded by Edward C. Johnson II in 1946, which is owned by employees and the Johnson family"

and

T.Rowe Price Group. Whose shareholders DON'T INCLUDE MICROSOFT.

:laugh: :laugh: :laugh: :laugh:

Exclusive: Microsoft Has Acquisition Deal With Nvidia

Watch For Microsoft To Acquire Nokia, Nvidia

Hold the Phone: Microsoft Wants to Buy Nokia AND Nvidia?

No way MS tolerates a minority shareholder. It would be 100% or nothing, and Nvidia's stock value puts it at $8.5bn without IP and on going service contracts.