Thursday, November 8th 2012

NVIDIA Reports Financial Results for Third Quarter Fiscal Year 2013

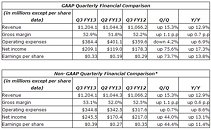

NVIDIA (NASDAQ: NVDA) today reported record revenue of $1.20 billion for the third quarter of fiscal 2013 ended Oct. 28, 2012, up 15.3 percent from the previous quarter and up 12.9 percent from a year earlier.

The company also announced that it is initiating the payment of a quarterly cash dividend, and extending its existing $2.7 billion share-repurchase program, initiated in August 2004, through December 2014.

"Investments in our new growth strategies paid off this quarter in record revenues and margins," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "Kepler GPUs are winning across the special-purpose PC markets we serve, from gaming to design to supercomputing. And Tegra is powering some of the most innovative tablets, phones and cars in the market."

He continued: "We are pleased to start paying our shareholders a quarterly cash dividend. We have confidence in our businesses and our continued ability to grow. Given our strong financial position and ongoing ability to generate cash, we are well positioned to continue investing in our future."Outlook

Our outlook for the fourth quarter of fiscal 2013 is as follows:

Diluted shares for the fourth quarter are expected to be approximately 629 million.

Dividend and Share-Repurchase Program

The quarterly dividend of 7.5 cents per share, 30 cents on an annual basis, is equivalent to a yield of about 2.4 percent, based on the Nov. 7 closing price of $12.61. It will be payable on Dec. 14, 2012 to all shareholders of record on Nov. 23, 2012.

Since NVIDIA initiated its repurchase program in August 2004, NVIDIA has spent $1.46 billion to repurchase 90.9 million shares of its common stock. NVIDIA is authorized, subject to certain specifications, to spend up to an additional $1.24 billion repurchasing shares of its common stock.

Any future repurchases would be made in the open market, in privately negotiated transactions or in structured share-repurchase programs, and may be made from time to time or in one or more larger repurchases. The program will be conducted in compliance with the Securities and Exchange Commission's Rule 10b-18 and applicable legal requirements and shall be subject to market conditions and other factors. The repurchases would be funded from available working capital.

Cash, cash equivalents and marketable securities at the end of the third quarter of fiscal 2013 were $3.43 billion.

Third Quarter Fiscal 2013 and Recent Highlights:

Commentary on the quarter by Karen Burns, NVIDIA interim chief financial officer, is available at www.nvidia.com/ir.

The company also announced that it is initiating the payment of a quarterly cash dividend, and extending its existing $2.7 billion share-repurchase program, initiated in August 2004, through December 2014.

"Investments in our new growth strategies paid off this quarter in record revenues and margins," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "Kepler GPUs are winning across the special-purpose PC markets we serve, from gaming to design to supercomputing. And Tegra is powering some of the most innovative tablets, phones and cars in the market."

He continued: "We are pleased to start paying our shareholders a quarterly cash dividend. We have confidence in our businesses and our continued ability to grow. Given our strong financial position and ongoing ability to generate cash, we are well positioned to continue investing in our future."Outlook

Our outlook for the fourth quarter of fiscal 2013 is as follows:

- Revenue is expected to be between $1.025 billion and $1.175 billion.

- GAAP and non-GAAP gross margins are expected to be flat relative to the prior quarter, 52.9 percent and 53.1 percent, respectively.

- GAAP operating expenses are expected to be approximately $400 million; non-GAAP operating expenses are expected to be approximately $359 million.

- GAAP and non-GAAP tax rates are expected to be approximately 20 percent and 19 percent, respectively, plus or minus one percentage point. This estimate excludes any discrete tax events that may occur during the quarter, which, if realized, may increase or decrease our actual fourth quarter GAAP and non-GAAP tax rates. If the U.S. research tax credit is reinstated into tax law, we estimate our annual effective tax rate for the fiscal year 2013 to be approximately 16 percent.

Diluted shares for the fourth quarter are expected to be approximately 629 million.

Dividend and Share-Repurchase Program

The quarterly dividend of 7.5 cents per share, 30 cents on an annual basis, is equivalent to a yield of about 2.4 percent, based on the Nov. 7 closing price of $12.61. It will be payable on Dec. 14, 2012 to all shareholders of record on Nov. 23, 2012.

Since NVIDIA initiated its repurchase program in August 2004, NVIDIA has spent $1.46 billion to repurchase 90.9 million shares of its common stock. NVIDIA is authorized, subject to certain specifications, to spend up to an additional $1.24 billion repurchasing shares of its common stock.

Any future repurchases would be made in the open market, in privately negotiated transactions or in structured share-repurchase programs, and may be made from time to time or in one or more larger repurchases. The program will be conducted in compliance with the Securities and Exchange Commission's Rule 10b-18 and applicable legal requirements and shall be subject to market conditions and other factors. The repurchases would be funded from available working capital.

Cash, cash equivalents and marketable securities at the end of the third quarter of fiscal 2013 were $3.43 billion.

Third Quarter Fiscal 2013 and Recent Highlights:

- Microsoft launched its NVIDIA Tegra 3-based Surface RT to critical acclaim.

- NVIDIA's new energy-efficient Kepler GPU architecture continued to make excellent headway:

o Kepler-based gaming was extended to new, lower price points with the launch of the GeForce 660 Ti, GeForce GTX 660, GeForce GTX 650 Ti and GeForce GTX 650.

o Kepler made further inroads in supercomputing, as Oak Ridge National Laboratory announced that it had completed Titan, the world's fastest open-science supercomputer. Titan gets 90 percent of its processing power from 18,688 NVIDIA Tesla GPUs.

o Kepler moved further into Apple's lineup, with the NVIDIA Quadro K5000 for Mac Pro users.

o NVIDIA launched the VGX K2 GPU, also based on the Kepler GPU, for cloud-based workstation graphics.

Commentary on the quarter by Karen Burns, NVIDIA interim chief financial officer, is available at www.nvidia.com/ir.

28 Comments on NVIDIA Reports Financial Results for Third Quarter Fiscal Year 2013

or in laymans terms, we sold mid ranged cards at high end prices and they still sold by the fucking truck load!!!!

You can Find the XFX R7950 BEDD for £210 this week online in UK sites that is LESS than what is asked for GTX660Ti models and especially after the 12.11 drivers all I have to say is LOL to ppl that still buy nVidia...

though on the long view perspective you could save £20-30 per year in electricity bills when picking new nVidia cards...

thats 670 (ball park) performance for 660 (not ti) money :eek:

i am a long time user of both camps and have tended to go nv in gaming builds but as it stands they wont be getting any of my money in the near future either and would get the 7950 today too.

@bt

yes they have the power draw, but thats more because they are mid ranged cards and not the full fat keplers.

They didnt want to disclose margins Fermi vs Kepler either. I guess its a good sign though since they only complained about yields twice this time.

Another highlight is project "Grey" is still being delayed +1yr delay now

This good news is all Holiday rollout so they are done for the year. If you take all things into consideration. With all the growth of Tegra / mobile that helped them out this year it only got them back to a flat margin. Much better then other companies but PC divions are flat and HPC is down and are forecasting to be down along with mobile next quarter.

Christmas came this quarter for Nvidia.

Tegra will be the best move Nvidia has made this year. If they hadnt they would be in the red.

You always make me laugh. I can at least give you that.

Everything is up at least 15% sequentially and at least 10% year on year, but it's the Tegra bussiness the only thing that "saved them" from red. :roll:

And I used quotation marks because they made record gross margins, so hardly "saved".

Consumer product revenue was $243.9 M up from $170.4M in Q2. Assuming it all comes from Tegra, some basic math says 243.9 - 170.4 = 73.5

Nope, $73.5M is not greater than net income of $209.1M. Even without that 209.1 - 73.5 = 135, still more than last quarter's $119M net income. So yeah...

504mil y/y net income Subtract the 300mil Intel pays annualy from court settlement.

Nvidia made 204mil net income this year. Thats 50mil a Quarter.

;)

1- Their bussiness model is based on their income and opportunities. If they didn't have the money from Intel, they would adjust. Fact is they have that money and is well deserve. They got it legitimately because they are losing FAR more from Intel unlawfully kicking them from the chipset market. Not to mention that Intel gets access to Nvidia patents, so this is basically income derived from IP.

2- $66M each quarter from Intel makes $264M annually not $300M.

3- Net income was $581M last year, not $504M, the difference adds up. This year with only 3 Quarters so far, they already adds up to $388M. They expect to be flat in respect to this quarter so add $200M and we're at around $580M (note that I added 192 and not 200 or 209).

580 - 264 = 316

316 / 4 = 79, which is still more than 73.

4- Comparing year figures is stupid, since it's this quarter we are talking about and effectively past quarters did worse, Tegra included, so dividing yearly figures by 4 and comparing them to the 35% increase this quarter is like I said below manipulating the numbers, and rather stupid. From above post, this qurter -> 135 (revenue minus tegra growth) - 66 (intel money) >>>> 0 (still much more than zero)

So even with your distorted, manipulated and utterly stupid proposition and numbers, you fail once again.

Q1 2012

60 mil

Q2 2012

119 mil

Q3 2012

209 mil

388 mil... so far

Intel agreement January 10 2012.

Net income 88mil so farYou dont run a company on what if's from speculating on a would be or posibility of a agreement. Any revenue derived from them is a bonus aside from your business model and/or forward outlook.:laugh:

Doesnt matter how the payments come in aslong as Intel pays 300mil annually as per the agreement.

Ask any Nvidia lawyer. I'm sure they tell you the same.Lets just take your numbers

580 to 388. they would have to make 192 in Q4 to break even with last year and thats with the 300 they got handed from Intel this year.

Q3 is there strongest quarter due to holiday shipments and thats already reported.

Might wants to take Jen-Hsun Huang member out of your orifices (oral and backside).

It just seams you get butt-ass hurt when anything remotely not cheerleading Nvidia you start bitching and cry'n like a little girl.

Try not to get too emo will ya..

:toast:

Tho in reality if they didn't have that money they would have much more coming from their chipset bussiness. They get that money for a reason and it's because they DON'T have chipset business, because Intel unlawfully kickd them from it, and Intel avoided this way a much more expensive lawsuit, which Intel knows very well.I don't need to ask anything since they have very clearly especified in their CFO commentary that it's a flat $66 million per quarter. And it does matter since we are commenting THIS quarter. THIS quarter has been exceptionally good, mostly in consumer products growth. But it's still relatively small and no it didn't save Nvidia from red since they were up in every segment. And THIS quarter:

209 - 73 (Tegra growth) - 66 (Intel money) = 70 >>>>>>>> 0

Averaging net income of all quarters, quarters that didn't do as well as this one and comparing that average net income to this quarter's Tegra success is blatantly stupid or simply deliberately manipulating the numbers to make an stupid comment look less stupid.Again irrelevant and stupid. They got Intel money last year too. It's LICENSED IP money. Intel gets Nvidia IP for this money.No. It's your stupid and false comments. Nothing to do with Nvidia. It's not my fault that in your desire to somehow hurt Nvidia in every Nvidia related thread, you commit such blatant stupidity. And I'm not trying to insult your personna, since I don't know you, I'm talking about your behavior and you act really stupidly on Nvidia related stuff, especially when it's related to financials. You look like a copycat of Charlie Demerjian, with eve less proofs to support your whicked ideas. You said they would be in the red if not for Tegra growth this quarter, which is utterly stupid. And my friend, it took you only 2 posts to resort to personal attacks this time. :laugh: You really are out of ideas aren't you?

Intel financials : No comment

AMD financials : Whine about Nvidia

Nvidia financials: Whine about Nvidia

BTW Xzibit, fun fact: Nvidia have long posted a better looking balance sheet than its principle competitor, and despite constant predictions of doom and gloom from you and the rest of the troll nation, still manage to maintain a sizeable cash reserve, and for the first time are looking to overhaul AMD in revenue ( $1.2bn for Nv, $1.27bn for AMD).

Anyways here is some whine for you...

Intel growth over 5yrs

gYS (+) 15,665 mil

gNI (+) 5,966 mil

gPS (+) 1.21

*Good

Nvidia growth over 5yr

gYS (-) 99.93 mil

gNI (-) 216.55 mil

gPS (-) 0.37

*Negative growth

AMD growth over 5yr

gYS (+) 555 mil

gNI (-) 2,888 mil

gPS (+) 5.93

*Too much debt not enough growth

I'll even throw Apple in here so you can understand

gYS (+) 124,029 mil

gNI (+) 36,899 mil

gPS (+) 38.79

*Great

Source: NASDAQ

Wait maybe if i have a shitty Q followed by a good Q I would rather talk about those percentage% differences because its a 3month window that certainly doesnt distort perspective and outlook. :rolleyes:

Maybe I should write Nvidia on my rear, I could use some kisses ;)

1. You've missed the point (yet again). Any thread leads you to have a cry about Nvidia- I just compared 3 threads that had financial returns in common, and,

2. Your facts make about as much sense as a cardboard submarine. Example: Your assertion that Microsoft could have bought Nvidia for $3.4bnwhen it took no more than basic comprehension to show that $3.4bn was for 30% of the shares IF Nvidia was in a selling mood....Yet you think MS would have turned down buying 100% of Nvidia for $3.4bn when Nvidia themselves had $3+bn in CASH reserveswithout even taking into account IP or any other facet of the organization...of course, the troll in you is probably thinking 2011 isn't 2012, but then, Nvidia have been stockpiling cash for quite some time.

It's been fun, and as always, seeing your posting reminds me of Kirk

www.youtube.com/watch?v=X6WHBO_Qc-Q

I dont see how pointing to there previous $1.46bil over 6yrs re-purchase of stock when your pointing out they have $3.4bil on hand.

Your saying they have the money but they wont or something else ?

I'm sure you read this partMS just had to have a majority of the shares hence it only needed 3.4bil to obtain. Giving them control over appointies and having control over the company if indeed it would want.

MS wouldnt need to own 100% of Nvidia just the majority stake. Thats why Nvidia had to alert investors and file with the S.E.C. of such a possibility at the time.

The re-purchasing announcement is to avoid such a possibility in the future but more so to show-up investor confidence during the global slow down.

At anytime Nvidia can raise capital by selling stock and reversing all this with having a bad quarter. Its like that with anyone.

It should be easy enough to follow. Nvidia used cash on hand to buy back a tranche of shares - This is IMMATERIAL other than the fact it demonstrates that NVIDIA HAS WORKING CAPITAL and made plans for its utilization.Self explanatory for anyone smarter than a garden vegetable.Bullshit. How many months on and you still can't grasp a simple concept.

In the event of Nvidia looking for a buyer (AND THEY WERE NOT), Microsoft had first option for 30% of Nvidia's shares- NOT A MAJORITY- 30%. Enough of a stake to trigger a takeover bid or block a takeover bid from another suitor.

All of this is a far cry from your assertion that Microsoft could have bought Nvidia for $3bn :laugh:Again, absolute bullshit. Microsoft were never offered the shares last year, and they certainly wouldn't have got Nvidia for 3.4bn if Nvidia have 3.4bn in cash on hand. You keep spewing garbage about non-existant "talks" to try to sound like some authority and justify a nonsensical argument based on you misinterpreting a news article :shadedshu

Your so funny thinking just cause a company has cash it cant change ownership.

I'll explain it to you in simpler terms.

The numbers have changed since last year but its still possible if Nvidia where to put up the 30% of stock.

As of last week:

-Nvidia still has 69% of its stock

-Microsoft through its holding has 15%

Nvidia

69 - 30 = 39

Microsoft

15 + 30 = 45

* 15 + 25 = 40 = Majority stock holder

The S.E.C. filing notes MS has 1st and last chance to exercise a purchase of those shares.

39 is less than 45. MS would just need to buy 25 of the 30 to have a majority. Since the value is down from last year and it wouldnt need to buy all 30 that were valued at 3.4bil it would be acquiring it for less then 3.4bil.

Yet another comprehension fail on your part, troll.

The issue is that you are expecting us to believe that Microsoft turned down an offer to buy Nvidia for less than Nvidia hold in cashAllow me to explain in simpler terms

MS buying Nvidia for <3.4bn when Nvidia hold 3.4bn in CASH reserves ? DOESN"T HAPPEN

...oh, and your flying off on a tangent to obfuscate the argument -classic troll move btw!- to make a theoretical case now to divert attention from your bs about supposed fact last year...well that doesn't bear much relation to the truth eitherBullshit.

Maybe you got confused since the the same mutual fund institutions that own Nv stock also own MS stock...either that or you're just posting a wall of bs. Maybe you should actually check the ownership rather than fabricating your own information.

Its right there in that link you provided.

Microsoft is majority holder in the top holdings. It also holds various shares on other of those holdings.

I simplified it for you... but you still dont get it.

You could go down the list and see Microsoft has % in several of those holdings listed there.