Monday, July 18th 2016

Softbank Acquires ARM for $32 Billion

Japanese conglomerate Softbank acquired British CPU architecture designer ARM in a USD $32 billion deal on Monday. Softbank's bid of $32 billion is a 43 percent premium over ARM's current valuation of $22.3 billion, and the Cambridge-based firm will recommend its shareholders to approve of its acquisition. Shares of ARM surged 45% on the LSE, adding £7.56 billion to its market value. The company reported revenues of $1.49 billion in 2015. ARM founder Herman Hauser, however, isn't happy with the board's decision. "This is a sad day for me and a sad day for technology in Britain," he stated.

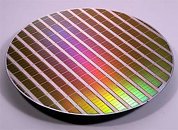

ARM designs CPU architectures, which it then licenses to other processor and SoC manufacturers, many of which are fabless themselves, making it an intellectual property giant. None of ARM's products are "tangible" or physical. While Intel, for example, designs CPU architectures (eg: x86), implements it (eg: Core i7, Celeron), and manufactures it (at its Costa Rica and Malaysia fabs) ARM's product is not tangible. It has a CPU architecture, which clients such as Samsung, Huawei, and Qualcomm license, implement (eg: Exynos, Kylin, Snapdragon), and contract-manufacture, through fabs such as GlobalFoundries, TSMC, and ST Microelectronics.

Source:

BBC

ARM designs CPU architectures, which it then licenses to other processor and SoC manufacturers, many of which are fabless themselves, making it an intellectual property giant. None of ARM's products are "tangible" or physical. While Intel, for example, designs CPU architectures (eg: x86), implements it (eg: Core i7, Celeron), and manufactures it (at its Costa Rica and Malaysia fabs) ARM's product is not tangible. It has a CPU architecture, which clients such as Samsung, Huawei, and Qualcomm license, implement (eg: Exynos, Kylin, Snapdragon), and contract-manufacture, through fabs such as GlobalFoundries, TSMC, and ST Microelectronics.

40 Comments on Softbank Acquires ARM for $32 Billion

It was the Tory party that deindustrialized the UK...........remember Maggie?

Hardinvestments ???

But she did do it her way HA!

Britain was the laughing stock when it voted to leave as many knew that the right-wing won its scare tactics of "them bad foreigners take our jobs!".

The only interesting part is how Scotland and Nothern Ireland will vote... If they also leave the UK - England will be completely... well... screwed.

Scotland will have another referendum if they want to stay; NI will also have to decide... both countries are heavily subsidised by the EU and they don't want to loose that. On top of that Scotland was heavily in favour of staying with the EU.

The Irish government already has confirmed that many companies, currently based in the UK, are checking their options to swap islands....

Scotland may have its own parliament, but to hold a national referendum it still needs permission from Westminster in London. Over 55% of the country voted to stay in the UK in the last independence referendum in 2014, undoubtedly a healthy margin which surprised expectations.

Scotland might not even be able to afford to be independent right now.

Scotland's claim to North Sea oil was major factor in the pro-independence campaigners' manifesto, but oil has more than halved in value in the last year and a half, as has the share prices of RBS which had to be rescued by the British government after the 2008 financial crash — further complicating any talk of Scottish secession.

Scotland's economy has grown far more slowly than the rest of the UK as a whole since the last recession, with just a 4% GDP growth compared to the UK economy as a whole which grew 23% in cash terms. This is not the picture of a country ready to go it alone, even with the EU membership it already enjoys.

And dont forget the huge bone of contention --

the little matter of joining the Schengen agreement, a treaty which effectively abolished border checks for member nations.