Thursday, July 9th 2020

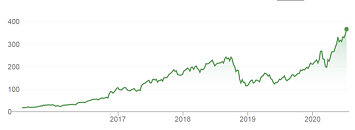

NVIDIA Surpasses Intel in Market Cap Size

Yesterday after the stock market has closed, NVIDIA has officially reached a bigger market cap compared to Intel. After hours, the price of the NVIDIA (ticker: NVDA) stock is $411.20 with a market cap of 251.31B USD. It marks a historic day for NVIDIA as the company has historically been smaller than Intel (ticker: INTC), with some speculating that Intel could buy NVIDIA in the past while the company was much smaller. Intel's market cap now stands at 248.15B USD, which is a bit lower than NVIDIA's. However, the market cap is not an indication of everything. NVIDIA's stock is fueled by the hype generated around Machine Learning and AI, while Intel is not relying on any possible bubbles.

If we compare the revenues of both companies, Intel is having much better performance. It had a revenue of 71.9 billion USD in 2019, while NVIDIA has 11.72 billion USD of revenue. No doubt that NVIDIA has managed to do a good job and it managed to almost double revenue from 2017, where it went from $6.91 billion in 2017 to $11.72 billion in 2019. That is an amazing feat and market predictions are that it is not stopping to grow. With the recent acquisition of Mellanox, the company now has much bigger opportunities for expansion and growth.

If we compare the revenues of both companies, Intel is having much better performance. It had a revenue of 71.9 billion USD in 2019, while NVIDIA has 11.72 billion USD of revenue. No doubt that NVIDIA has managed to do a good job and it managed to almost double revenue from 2017, where it went from $6.91 billion in 2017 to $11.72 billion in 2019. That is an amazing feat and market predictions are that it is not stopping to grow. With the recent acquisition of Mellanox, the company now has much bigger opportunities for expansion and growth.

136 Comments on NVIDIA Surpasses Intel in Market Cap Size

It is one ramifying feature. Like AMD's rapid packed math, but for hpc.

Navi 21;

Navi 22;

Navi 23.

Soon, so that their releases approach quickly.This is pure speculation without taking consideration that the purchase of ATi actually led AMD to very nasty financial position. AMD overpaid heavily for ATi.

And given that today the best products from AMD are all Zen-based, the Radeon lineup is somewhere third or fourth in the priority list, I think that AMD without ATi would have been in a much better situation today.

And mind you, 480 was the absolute fastest single-gpu card back then, while 5700xt is a paltry upper-mid range one. Some versions with proper cooling (unfortunately rare) were much different beasts:

First settlement:

Intel to pay AMD $1.25 billion in antitrust settlement

AMD drops its litigation while Intel agrees to "abide by" a long list of prohibitions. And renewed patent cross-license agreement frees AMD to spin off chip manufacturing.

www.cnet.com/news/intel-to-pay-amd-1-25-billion-in-antitrust-settlement/

Second fine:

Antitrust: Commission imposes fine of €1.06 bn on Intel for abuse of dominant position; orders Intel to cease illegal practices

ec.europa.eu/commission/presscorner/detail/en/IP_09_745

I do, they're still fighting it.

Also, Microsoft and Google get fined, too.

ec.europa.eu/commission/presscorner/detail/en/IP_13_196

ec.europa.eu/commission/presscorner/detail/en/IP_19_1770

While AMD has never been a true underdog - it was artificially forced to look like one.

The first stage is denial ...

Companies like Nvidia....overcharging just because they can (consumer mistake really) and killing tech or its potential.... not really rooting for them.