Monday, September 14th 2020

Samsung Foundry to Become Sole Manufacturer of Qualcomm Snapdragon 875 on 5 nm EUV Manufacturing Process

Rumors fresh of South Korean shores claim that Samsung has snagged a position as sole provider for Qualcomm's Snapdragon 875 SoC on its 5 nm EUV manufacturing process. The reason for this, according to a supposed industry insider, boiled down to money (as it almost always does): Samsung simply offered lower pricing for chips manufactured under its 5 nm EUV process than TSMC did. The deal has been claimed to be worth some $840M. This makes sense, as Samsung has a considerable product portfolio - including lucrative memory fabrication - from which it can pool resources so as to lower pricing for new manufacturing technologies, whereas TSMC can only count on revenues it brings in from contracted silicon manufacturing deals.

Samsung's 5 nm EUV will still offer the now tried-and-true FinFet transistor design - next-generation GAAFET (gate all-around FET) are reserved for the companies' 3 nm efforts. This piece of news directly contradicts Digitimes' earlier reporting on Qualcomm leaving Samsung as a foundry partner due to lower than adequate yields for Samsung's 5 nm EUV. With Samsung already manufacturing NVIDIA's Ampere on its 8 nm node, and now with a confirmed high-volume client with Qualcomm, this likely means more available capacity for other TSMC clients - of which we could mention AMD and Apple.

Sources:

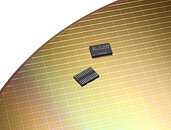

Hankyung, Snapdragon 875 Image courtesy of WCCFTech

Samsung's 5 nm EUV will still offer the now tried-and-true FinFet transistor design - next-generation GAAFET (gate all-around FET) are reserved for the companies' 3 nm efforts. This piece of news directly contradicts Digitimes' earlier reporting on Qualcomm leaving Samsung as a foundry partner due to lower than adequate yields for Samsung's 5 nm EUV. With Samsung already manufacturing NVIDIA's Ampere on its 8 nm node, and now with a confirmed high-volume client with Qualcomm, this likely means more available capacity for other TSMC clients - of which we could mention AMD and Apple.

15 Comments on Samsung Foundry to Become Sole Manufacturer of Qualcomm Snapdragon 875 on 5 nm EUV Manufacturing Process

A couple of weeks ago Samsung was proudly announcing how they plan to make the best SoCs out there after falling behind with each passing year against Qualcomm. Part of that was because Qualcomm was using TSMC's nodes which were always superior, now suddenly we find out they're all going to be on equal footing.

Hmmm ... OK.

If TSMC really is that more expensive than going with a relatively unproven fab like Samsung, I'm expecting to see news of AMD CPUs and/or GPUs being manufactured by Samsung sooner or later. AMD does have some announcements coming up next month, so perhaps...Nah, Snapdragon has always simply been a better design than Exynos. No process node advantage is going to magically make the latter good, at this point Exynos is merely a money-draining point of misplaced pride for Samsung.

TSMC also has a lot of fabs and Apple wouldn't even want to produce on some of the nodes that TSMC manufacturers at.

en.wikipedia.org/wiki/TSMC#Facilities

And even if it doesn't, if they were to "bet the farm" on Apple taking all their newest node capacity and then get shafted, they'd be sitting with a massive amount of the most expensive node capacity idling. That's a big one, since node manufacturing contracts aren't particularly short-term or flexible.

Unfortunately, "best interests" sometimes take a back seat, particularly when executive compensation is tied to short-term profits.

And Apple is Apple, they don't have to produce anything. If they decide to buy all of TSMC's cutting-edge node capacity (and not use it) just to prevent Qualcomm et al from having it, do you think TSMC would care?

Their price not only is lower, but they also offer special conditions, like the deal they have offered Nvidia where they are selling them only the good chips, not the whole wafer. This makes is a pretty sweet deal financially, with the only risk being availability, but I imagine that they can invest in order to improve yields. Also, from what I understand, the Samsung 5nm node is not so advanced compared to the 8 nm, which should mean that the risk isn't huge either.

Anyway, the fact that Samsung keeps investing and getting deals for the foundry is good for the market, it's keeping it sane and competitive. we wouldn't want a market in which there is only one well-performing foundry, it wouldn't be very good for the final users.

It's just that until now, Samsung didn't really have any big orders from big US semiconductor designers. Now they've got two (NVIDIA and Qualcomm) in a relatively short period of time. While the financial incentive is definitely there, the conspiracy theorist in me wonders if US semiconductor companies are anticipating a China-Taiwan conflict that would impact supply lines...

Samsung should drop all the Exynos manufacturing line and prioritise Qualcomm :laugh: ....

that's quite a laugh to get a Note 20 Ultra same price, which is already too high for what it is, as the other one, but getting an Exynos instead of a SD ....

In the short run, I doubt AMD will move anything to Samsung, from TSMC. I sense AMD's strategy to keep cost down at TSMC is to not go with the cutting edge fab, but instead let the bigger players like Apple take the lead. They will then fill in the gap when Apple and big players move on to the newer fab.

But I agree, European customers getting stuck with the POS Exynos while the rest of the world gets the much better Snapdragon is BS. If it was the USA, Samsung would've already been sued.

(i love my TCL 10 Pro midrange price and spec , flagship build and serve me well for anything i could ask of it )