Thursday, July 24th 2025

Intel Reports Second-Quarter 2025 Financial Results

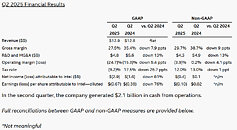

Intel Corporation today reported second-quarter 2025 financial results.

"Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency," said Lip-Bu Tan, Intel CEO. "We are laser-focused on strengthening our core product portfolio and our AI roadmap to better serve customers. We are also taking the actions needed to build a more financially disciplined foundry. It's going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value.""Our results reflect solid demand across our business and good execution on our priorities," said David Zinsner, Intel CFO. "The changes we are making to reduce our operating costs, improve our capital efficiency and monetize non-core assets are having a positive impact as we work to strengthen our balance sheet and position the business for the future."

Progress on Driving Greater Efficiency and Execution

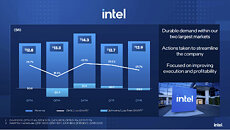

Intel continues to make progress to simplify its business, improve efficiency and enhance execution. These efforts are focused on reducing expenses, strengthening the balance sheet, optimizing the global footprint and concentrating resources on the most critical growth areas.

These restructuring charges and impairments were not incorporated into the guidance Intel provided for the second quarter of 2025.Business Unit Summary

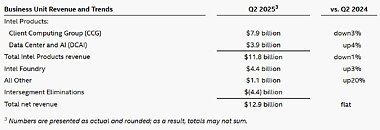

In the first quarter of 2025, the company made an organizational change to integrate the Network and Edge Group (NEX) into CCG and DCAI and modified Intel's segment reporting to align to this and certain other business reorganizations. All prior-period segment data has been retrospectively adjusted to reflect the way Intel's chief operating decision maker internally receives information and manages and monitors the company's operating segment performance. There are no changes to Intel's consolidated financial statements for any prior periods.Business Highlights

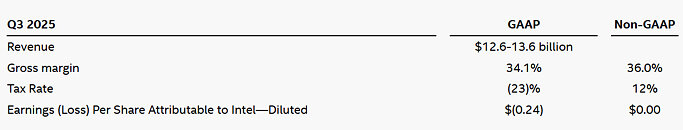

Intel's guidance for the third quarter of 2025 includes both GAAP and non-GAAP estimates as follows:Reconciliations between GAAP and non-GAAP financial measures are included below. Actual results may differ materially from Intel's business outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. The gross margin and EPS outlooks are based on the midpoint of the revenue range.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PDT today to discuss the results for its second quarter of 2025. The live public webcast can be accessed on Intel's Investor Relations website at www.intc.com. The corresponding earnings presentation and webcast replay will also be available on the site.

Source:

Intel

"Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency," said Lip-Bu Tan, Intel CEO. "We are laser-focused on strengthening our core product portfolio and our AI roadmap to better serve customers. We are also taking the actions needed to build a more financially disciplined foundry. It's going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value.""Our results reflect solid demand across our business and good execution on our priorities," said David Zinsner, Intel CFO. "The changes we are making to reduce our operating costs, improve our capital efficiency and monetize non-core assets are having a positive impact as we work to strengthen our balance sheet and position the business for the future."

Progress on Driving Greater Efficiency and Execution

Intel continues to make progress to simplify its business, improve efficiency and enhance execution. These efforts are focused on reducing expenses, strengthening the balance sheet, optimizing the global footprint and concentrating resources on the most critical growth areas.

- On track to achieve $17 billion non-GAAP operating expense target for 2025: Intel has completed the majority of the planned headcount actions it announced last quarter to reduce its core workforce by approximately 15%. These changes are designed to create a faster-moving, flatter and more agile organization. As a result of these actions, the company recognized $1.9 billion in restructuring charges in the second quarter of 2025, which were excluded from its non-GAAP results. These charges impacted GAAP EPS by $(0.45) per share. Intel plans to end the year with a core workforce of about 75,000 employees as a result of workforce reductions and attrition.

- Improving capital efficiency; driving to gross capital expenditures of $18 billion for 2025: Intel is taking action to optimize its manufacturing footprint and drive greater returns on invested capital. As part of this effort, Intel will no longer move forward with planned projects in Germany and Poland. The company also intends to consolidate its assembly and test operations in Costa Rica into its larger sites in Vietnam and Malaysia. In addition, Intel will further slow the pace of construction in Ohio to ensure spending is aligned with market demand.

These restructuring charges and impairments were not incorporated into the guidance Intel provided for the second quarter of 2025.Business Unit Summary

In the first quarter of 2025, the company made an organizational change to integrate the Network and Edge Group (NEX) into CCG and DCAI and modified Intel's segment reporting to align to this and certain other business reorganizations. All prior-period segment data has been retrospectively adjusted to reflect the way Intel's chief operating decision maker internally receives information and manages and monitors the company's operating segment performance. There are no changes to Intel's consolidated financial statements for any prior periods.Business Highlights

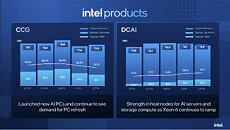

- Intel launched three new additions to its Intel Xeon 6 series of central processing units (CPUs), delivering customizable CPU core frequencies to boost graphics processing unit (GPU) performance across demanding AI workloads. One of these, the Intel Xeon 6776P processor, currently serves as the host CPU for NVIDIA DGX B300, the company's latest generation of AI-accelerated systems.

- The first Panther Lake processor SKU remains on track to begin shipping later this year, with additional SKUs coming in the first half of 2026.

- Intel 18A reached a key milestone with the start of production wafers in Arizona.

- Intel made key leadership appointments, including Greg Ernst as chief revenue officer and Srinivasan Iyengar, Jean-Didier Allegrucci and Shailendra Desai in key engineering leadership roles.

- In line with Intel's commitment to strengthen its balance sheet and monetize non-core assets, the company sold, via a secondary offering, 57.5 million of net Class A shares of Mobileye in July 2025, adding approximately $922 million to the balance sheet. Intel remains the majority shareholder in Mobileye and continues to have strong conviction in its long-term growth opportunity.

Intel's guidance for the third quarter of 2025 includes both GAAP and non-GAAP estimates as follows:Reconciliations between GAAP and non-GAAP financial measures are included below. Actual results may differ materially from Intel's business outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. The gross margin and EPS outlooks are based on the midpoint of the revenue range.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PDT today to discuss the results for its second quarter of 2025. The live public webcast can be accessed on Intel's Investor Relations website at www.intc.com. The corresponding earnings presentation and webcast replay will also be available on the site.

18 Comments on Intel Reports Second-Quarter 2025 Financial Results

come on intel...get competitive again... trim that fat like its a beef brisket...

The GAAP metrics: oh NO

Hoping they can navigate their way out of this pit they've dug themselves in, but great googly moogly those are some dire numbers.

Please be specific.

newsroom.intel.com/corporate/lip-bu-tan-steps-in-the-right-direction

You noticed revenue was up from last year, yes?

Here’s their 10-Q

www.intc.com/filings-reports/all-sec-filings/content/0000050863-25-000109/0000050863-25-000109.pdf

Intel is going to be fine.

PS Here is AMD after Intel's results,

Since you couldn’t get your second sentence correct I stopped reading after that.

By the way, you missed my point entirely, but never mind. I am not going to make it any harder for you.

The non-GAAP metrics: oh no, not again.

The GAAP metrics: OH NOOOOOOOOOOOOOOOOOOOOOOOOOOOO!!!!!!!!!!

Shame, i don't wish for Intel to fail. Probably none of us would be typing into a PC without Intel.

It's a tricky place to be, but if you just keep changing a plan that takes 5 years to be successful every 3 months, you'll never be successful on any long term plan.